The European Monetary Union: More Stable than Ever

Jörn Quitzau

Bergos AG

Joern Quitzau is a Geoeconomics Non-Resident Senior Fellow at AGI. He is Chief Economist at Bergos, a private bank based in Switzerland. He specializes in economic trend research and economic policy. Joern Quitzau hosts two Economics podcasts.

Prior to his position at Bergos, Joern Quitzau worked for Berenberg in Hamburg (2007-2024) and Deutsche Bank Research in Frankfurt (2000-2006) with a special focus on tax and fiscal policy.

Dr. Quitzau (PhD, University of Hamburg) was a Visiting Fellow at AGI in April 2014 and September 2022 and an American-German Situation Room Fellow in April 2018.

While the European debt crisis was raging in the financial markets, an old question resurfaced: can the euro survive on a sustained basis even though the currency does not meet the criteria of a so-called optimum currency area? Many economists were mistrusting the concept of European Monetary Union (EMU) long before the euro was launched because the member states’ economies were too different. In addition, cross-border migration was not expected to be a serious adjustment mechanism in the event of asymmetric macroeconomic shocks. According to economic theory, mobility of the workforce is a good shock absorber, as labor market imbalances can be eliminated by people who migrate to where the jobs are.

Knowing of these imperfections, the founding members of the EMU called for economic and financial convergence among the potential member states. The convergence criteria of the Maastricht treaty addressed the convergence of 1) inflation rates, 2) budget deficits, 3) debt-to-GDP ratios, 4) long-term interest rates, and 5) the stability of exchange rates. After the euro was launched in 1999, it was the mission of the Stability and Growth Pact (SGP) in combination with the “no bailout rule” to ensure fiscal discipline in the EMU, or rather, its member states. Until 2009—when the Greek crisis took its course—the Maastricht convergence criteria as well as the SGP had delivered reasonable results. Although fiscal discipline and compliance with SGP rules could have been much better, the euro managed to become a respected and well-established currency—it was riding high as an international reserve currency, having emerged as the number two after the U.S. dollar.

However, from the moment Greece revealed the grim truth about its fiscal problems in late 2009, investors started to reconsider the structural make-up of the EMU. A currency with a centralized monetary policy but without a centralized fiscal policy: could that really be a successful concept? Far-reaching skepticism among investors led to the widespread expectation of a potential euro collapse. Although capital markets have calmed down significantly, the (academic) discussion about the deficiencies of the EMU’s monetary and especially fiscal architecture continues. Some observers still stick to their view that the structural weaknesses of the EMU are so substantial that the euro can only survive when the monetary union will be completed with the implementation of a cross-border transfer mechanism (“transfer union”). This view is all the more surprising given that the father of the “optimum currency area theory,” Nobel laureate Robert Mundell, himself steadfastly rejects the idea of a transfer union. Mundell points out that the EMU was well-conceived and that the euro will succeed when the member states stick to the rules of the reformed Stability and Growth Pact.

Actually, the debate about the euro contains a misconception. Many critical issues that appeared during the past few years—such as macroeconomic imbalances, a lack of competitiveness, or high debt-to-GDP ratios of several member states—were attributed to the alleged faulty design of the euro. Several issues indeed had an effect on the stability of the euro zone. However, not every problem that has caused turbulence in the euro zone is the fault of a defective euro design. Some of the troubles affecting the euro zone were caused abroad. For example, from 2007 until 2010, the euro zone debt-to-GDP ratio rose from 66 percent to 86 percent, but this massive increase had nothing to do with the monetary and fiscal architecture of the euro zone—it was simply the result of the global financial crisis. Euro member states had to fight the recession via counter-cyclical fiscal policy. In addition, national governments had to support financial institutions that were in trouble because of the U.S. sub-prime crisis. The simple truth is that these problems would have had the same impact on EU member states’ public finances if they had retained their own national currencies.

In the following I would like to emphasize an issue that can partly be attributed to the faulty design of the euro zone as well as to more global, non-euro zone specific factors, as well as the phenomenon of market panics in European bond markets and the question of how to handle them. A special case of a market panic is the case of a self-fulfilling prophecy: When investors expect a country’s default on its sovereign bonds, this expectation will cause a sell-off in the bond market and this sell-off can indeed precipitate the default. Thus, erroneous expectations can cause a sovereign default even if a country’s fundamentals are quite solid.

Obviously, market panics do not only occur within the euro zone. But in recent years only the euro zone was about to collapse because of a market panic. What were the reasons behind the panic and could it happen again? The European Central Bank (ECB) as well as the new European Stability Mechanism (ESM) play a major role in this regard.

The assumption that financial markets act rationally and thus behave according to the efficient market hypothesis is crucial for determining a proper architecture for the EMU. If the architecture is based on appropriate assumptions, the EMU would be able to operate in a stable and credible fashion and its member states would be able to comply with the budget targets set by the SGP. If financial markets process information efficiently, and thus always reflect economic reality, increasing interest rates on government bonds correctly reflect deteriorating fundamentals. In this case, there is no need for institutions such as the ESM, which is supposed to intervene in sovereign bond markets. In contrast, if markets overshoot, this alone can damage the real economy and may require ESM action. Since the turn of the millennium, the overshooting phenomenon can be observed multiple times—for example, in the dot-com bubble, in the U.S. real estate bubble, and in the significant fluctuations in commodity prices between 2007 and 2009.

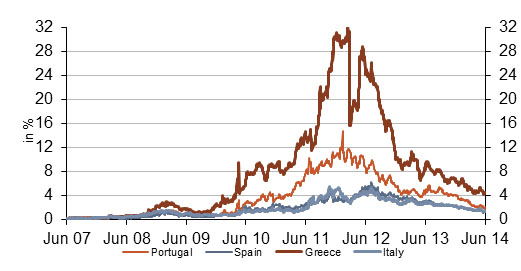

Despite these recent events, the old stock market wisdom that “the market is always right” still holds. In fact, parts of the academic community still believe that markets do not overshoot. Therefore, it is of interest to take a closer look at the interest rate developments for government bonds in European capital markets. Figure 1 compares the interest rate differentials of German government bonds to 10-year treasury bonds for the crisis countries Portugal, Spain, Greece, and Italy. The spread portrays the risk premium that is paid for treasury bonds. It is apparent that interest rate differentials were minimal until 2008—it was only at the end of 2009 when Greece’s economy plunged into crisis that investors’ nervousness spread to international markets.

Figure 1: Spreads vs. 10-year Bunds

In other words, until late 2008, market players evidently did not see any noteworthy reasons to question the creditworthiness of today’s crisis countries; at least, no risk premiums were paid to market players for existing risks. In addition, market monitors knew about the existing problems long before 2009. However, it was only during the euro crisis itself that investors began expressing their doubts about the eventual recovery of the troubled countries. International investors already knew about Greece’s “creative” use of official statistics as well as the country’s weak industrial base as imports outweighed exports. Likewise, investors knew about Greece’s large informal economy and the severe effect this was having on the efficiency of the tax system. Since its accession to the euro zone, Greece has run a high budget deficit and thus has violated the SGP year after year. Moreover, the associated risks with Greece’s economy had been obvious for a long time as the average debt level clearly exceeded 100 percent of GDP.

Italy’s debt burden had also been significantly above 100 percent of GDP for many years by the time the financial crisis hit the markets in 2008. Market players had been aware of Italy’s macroeconomic outlook, as well as the political escapades of Prime Minister Silvio Berlusconi. However, investors did not doubt the ability and willingness of countries like Italy and Greece to repay their debt. Investors acted overly confidently and neglected to provide incentives to the respective governments to make sound fiscal cuts by demanding higher interest payments. In retrospect, we know that investors’ assessments of whether debtors are able and willing to repay their debt does not change gradually but instantly. Hence, the demanded risk premiums rose with leaps.

Abrupt mood swings in the market—as illustrated by the spread in interest rate differentials in Figure 1—has clear implications from a regulatory perspective. With abruptly-changing risk premiums, the early warning attributes of financial markets would become invalid. In this case, financial markets do not act preventatively but simply punitively. Thus, it would be gross negligence to leave control of public finances primarily to financial markets.

The decisive keywords for the EMU are “contagion” and “self-fulfilling prophecy”—two terms that should not exist in a world of efficient financial markets. However, the events of summer 2011 showed that contagion was a real risk as the crisis spread to other countries within the monetary union. When EU member states agreed to cut the debt burden of private creditors in Greece, even interest rates of those bonds not affected by the cut, such as Spanish and Italian government bonds, promptly surged.

In addition, there is the risk that negative sentiments are self-fulfilling: If a sufficient amount of financial market participants believes that a country is about to go bankrupt, that country will soon be denied access to international capital markets. Thus, sovereign default may be the result of psychological factors even if fundamental data does not yet point to the country being in a depressed state.

After the experience of the past fifteen years, there should be no doubt that markets heavily overshoot from time to time. Reasons for irrational exuberance are, among others, people blindly following “rules of thumb” and herd behavior, and adherence to stock market wisdoms like “never catch a falling knife.” The EMU was established when irrational exuberance was only considered to be relevant to a minor extent. Faith in the efficiency and rationality of markets was strong. As a consequence, there was no perceived need for an institution to act as a backstop in market panic situations, and so there was no such institution in place when the destructive panic spread in 2009. Furthermore, the euro zone’s “no bailout rule” was made for a world in which only self-inflicted government defaults were expected to be possible. Defaults as a result of contagion were largely unthinkable.

If unsettled investors continue to avoid the euro zone, however, then the ESM and the ECB will act as a last resort to provide financing (as conditional aid) and thus can credibly back up the reform process in Europe. Since Mario Draghi delivered his “whatever it takes” speech in 2012, the ECB has taken the role of backstop to protect the euro zone in the event of an irrational market panic threatens to destroy the monetary union. No wonder that financial markets are not scared about a potential euro collapse any longer and that they have calmed down significantly since 2012. In this regard, the euro zone has solved one of its main problems, and the monetary union can be considered to be more mature today than it was five years ago. The ECB now is able to react like many other central banks do, if need be.

Nonetheless, there is a wide range of potential problems associated with the ESM and the ECB fulfilling this role. Financial support may only be temporary to avoid moral hazard problems. And financial support should only be conditional, i.e., countries have to be committed to structural reform programs. The euro zone has decided for exactly that way: Financial support is granted only temporarily and only in exchange for structural reforms.

The ESM and ECB as backstops in the event of market panics is one key element of the new euro zone architecture. Combined with the other elements such as the Banking Union, the reformed Stability and Growth Pact, and the Fiscal Compact (including national debt brakes), the European Monetary Union is much more robust today. For the time being, there is no need for further reforms.

Jörn Quitzau is a Senior Economist at Berenberg, Germany’s oldest owner-managed private bank, and was a Visiting Fellow at AGI in April 2014. The views expressed are his alone.