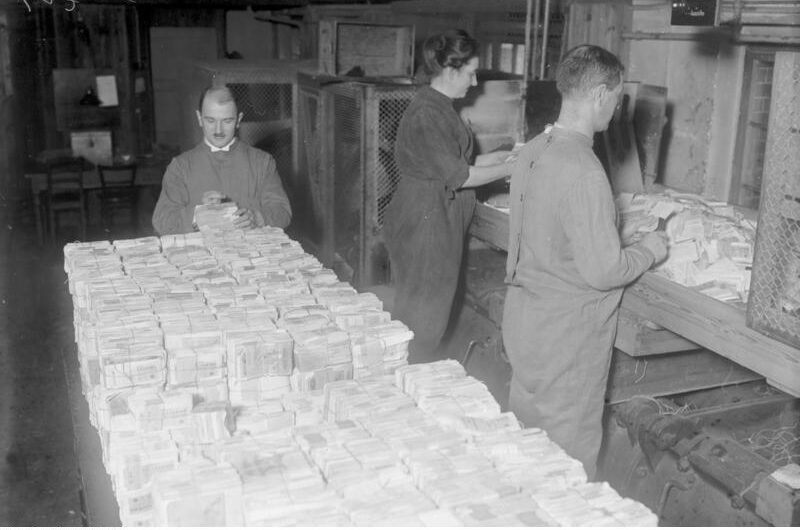

German Federal Archive via Wikimedia Commons

Hyperinflation Weimar

Luisa Latella

Halle Foundation/AGI Intern

Luisa Latella is a research intern at AGI for the fall of 2023. She assists resident fellows with their research projects, manages databases, and helps organize and document events. Ms. Latella is an exchange student at American University as part of her bachelor’s degree in Political Science with a minor in Law at Ludwig-Maximilian-University in Munich. In her studies, she focuses particularly on international relations and the impact of power shifts in the international system on transatlantic relationships. At LMU, she works as a student assistant at the Chair of Global Governance and Public Policy researching international organizations and transatlantic relations.

One hundred years ago, the Weimar inflation reached its peak. It remains Germany’s greatest economic crisis and has heavily shaped the history of the Federal Republic. Within a few months in the 1920s, the German mark lost almost all its value, driving many German families into financial ruin. Now, many Germans fear that history is repeating itself and that the current inflation will have a similar impact on their lives.

Causes of the Weimar inflation

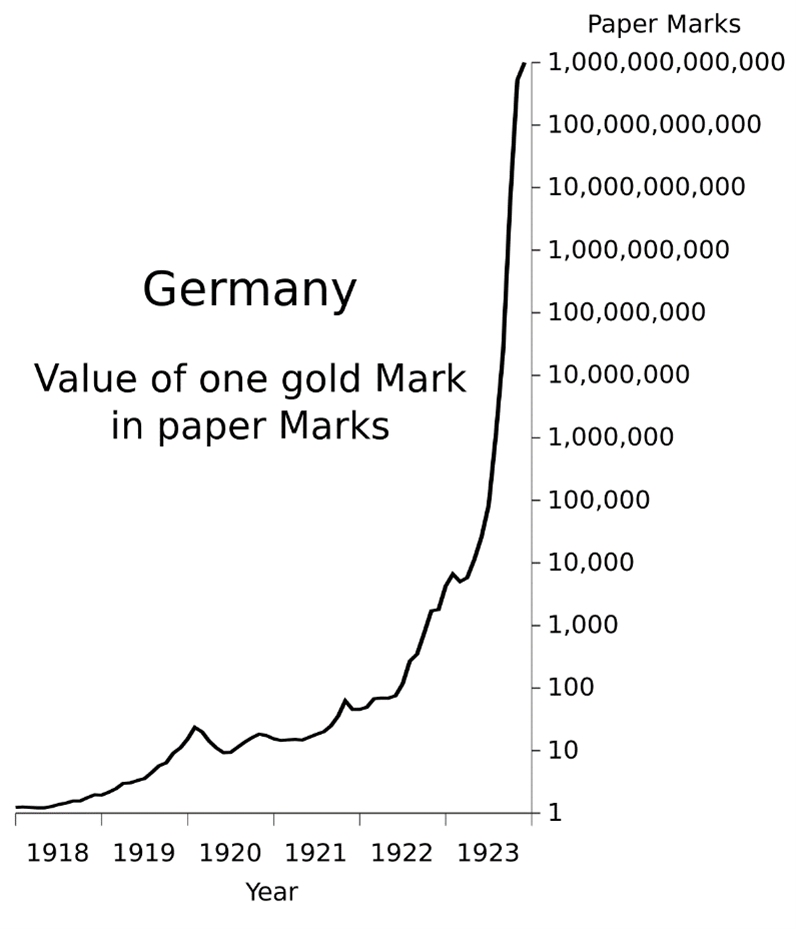

Germany’s assets at the beginning of World War I in 1914 would have been sufficient to finance only about two days of the war. Convinced that it would win the war and thus be reimbursed by the losing nations, Germany used war bonds (Kriegsanleihen) to borrow money from its own citizens. In addition, more and more banknotes were printed to meet the growing demand. Between 1914 and 1918, the amount of money in circulation quintupled and inflation set in. Germany was not the only country that wanted to cover the immense costs of the war through reparations. With the Versailles Peace Treaty, the German state was forced to pay enormous reparations to the victorious powers after losing the war in 1918. The exact sum amounted to 132 billion gold marks, or more than $500 billion today, and the annual payments up to the end of the 1920s amounted to around 2.5 percent of the German GDP. The poor general economic environment, the high reparations payments, and social tensions contributed to a deteriorating economic situation, resulting in Germany falling behind with the payments. Due to the unpaid reparations, France and Belgium occupied the Ruhr, a coal-rich industrial region of Germany, in 1923 to extract resources as payment. German factory workers refused to cooperate with the occupying French and Belgian armies. With the German government’s support, two million people in industry, administration, and transportation went on strike, still receiving two-thirds of their wages. As a result, the already challenged government budget was thrown completely out of balance—marking the beginning of what would later become known as the hyperinflation of the Weimar Republic.

Hyperinflation and its consequences for the young Weimar Republic

The ever-increasing inflation had dramatic consequences for the population. Within a month, the prices of goods doubled, which the Reichsbank tried to combat by printing new banknotes, creating a vicious circle.

Many families lost their entire fortunes during this period, and the supply of basic goods was no longer guaranteed, leading to riots and looting. In many large cities, black markets for food and everyday goods emerged, and due to the high prices and limited goods, starvation loomed by fall 1923. In addition, there were severe outbreaks of tuberculosis and, as an indirect result of malnutrition, higher infant mortality rates. Worries about money and the uncertain future dominated daily life.

To combat inflation, a new currency, the Rentenmark, was issued on November 15, 1923. Since the Weimar Republic did not have sufficient gold reserves to cover the capital stock of the Rentenbank—the state’s monetary authority—agricultural and industrial land was mortgaged to the tune of 3.2 billion Rentenmark. In the following months, Finance Minister Hans Luther and Reichsbank President Hjalmar Schacht managed to keep the exchange rate of the new currency stable by restricting the circulation of money and implementing drastic austerity measures in the budget. The normalization of economic life and the calming of the domestic situation was later referred to as the “miracle of the Rentenmark.” However, the Rentenmark was only introduced as a temporary solution to overcome inflation. On August 30, 1924, under the Dawes Plan, it was replaced by the Reichsmark, marking the end of the difficult economic period. However, hyperinflation left its mark on more than just the economy. Many people lost their entire fortune to inflation and with it, their confidence in the young republic. The population was divided by this; especially farmers felt “estranged” from the established political parties which destabilized the republic for the rest of its short life, circumstances from which the Nazis profited.

Impact of hyperinflation on modern Germany

“Not all Germans believe in God, but they all believe in the Bundesbank,” is a well-known quote by Jacques Delors, former President of the European Commission. The Deutsche Bundesbank Act of July 26, 1957, established today’s German central bank. Since then, the independent Bundesbank has successfully pursued its stated goal of price stability—a concern that was later also added to the mandate of the European Central Bank. Delors also addressed German “stability culture”—a particular affinity for balanced government budgets and a constant fear of inflation. Although hyperinflation has been over for many years, the fear of inflation seems to have persisted—but why?

Inflation is not only an economic burden for the German population but also a source of social and political tension.

According to historian Gerald Feldman, the hyperinflation of Weimar left a “trauma burned into the collective memory” long after its economic and political impact. It is now widely recognized that shocks early in life can shape political attitudes and perceptions of problems for a lifetime. This is also the case with inflation. It can also be shown that the political behavior of grandparents systematically influences that of their grandchildren. So if those who lived through 1923 were shaped by it for the rest of their lives and passed their experiences on to their descendants, it is at least not far-fetched that these experiences continue to shape German politics today. The fact that the hyperinflation of 1923 in particular had such a formative effect on the German population can also be traced back to a large extent to the way in which the discourse on hyperinflation is constructed: whenever hyperinflation is mentioned, a reference is automatically made to Hitler’s rise to power and the resulting Second World War. Former Economics Minister Rainer Brüderle said in 2011, “One lesson of history is that when money goes bad, everything goes bad. We’ve had that in German history, too: from hyperinflation to mass poverty to war and the fatal undesirable developments in Germany.” This type of discourse about hyperinflation in Weimar explains the deep-seated trauma of Germans and their constant fear of inflation.

Is the Weimar hyperinflation comparable to today’s inflation in Germany?

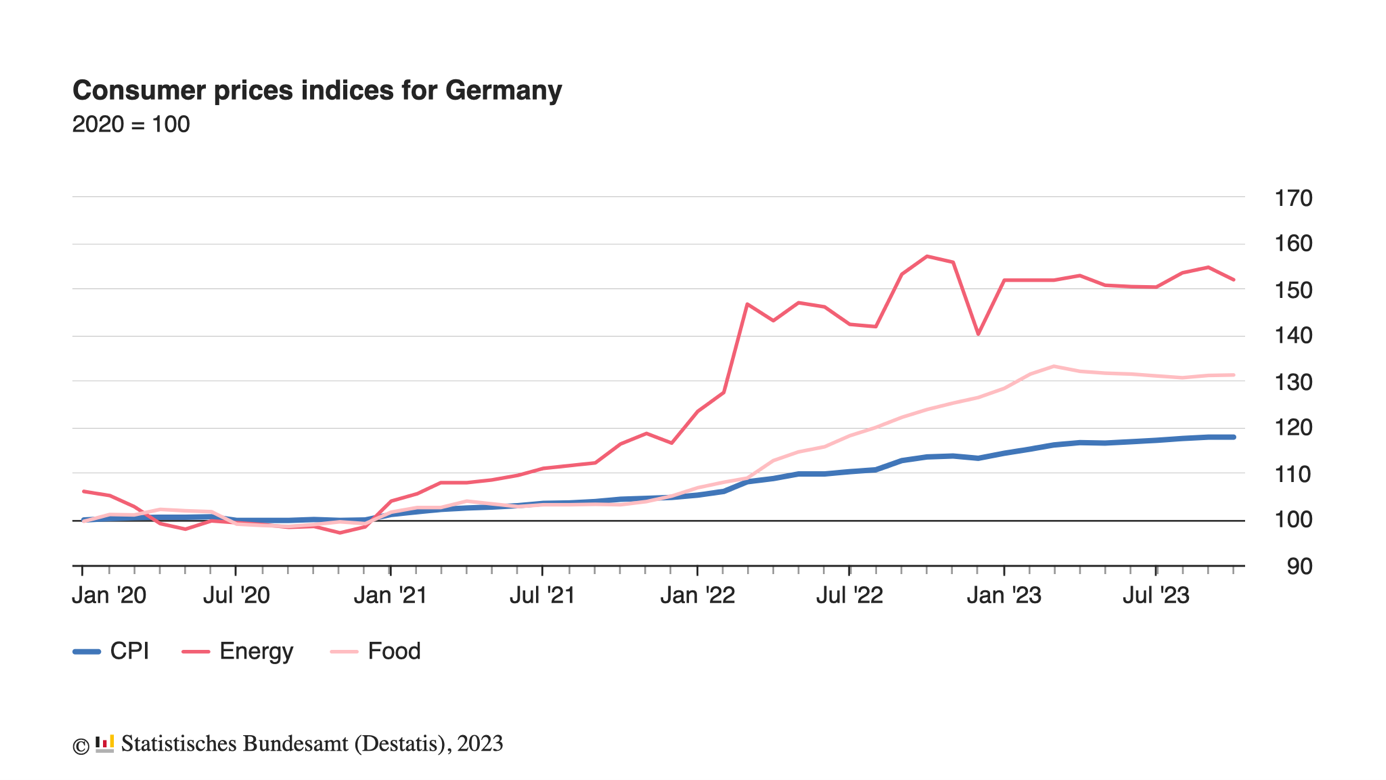

Of course, analogies can be drawn between the situation in Germany today and the inflation of the Weimar Republic. Inflation can often be traced back to war. Even though Germany is not actively involved in the war in Ukraine, the war is having a major impact on gas supplies, cutting into an important resource. In addition, the European Central Bank had been pursuing a loose monetary policy in the years before, which is often conducive to inflation.

German society sees the current inflation as the most severe burden and crisis currently threatening the country. And the citizens’ fears are not unjustified. Since the beginning of the war, the cost of living in Germany has risen to a record high. According to the Federal Statistical Office of Germany, food prices rose by almost 30 percent between July 2021 and July 2023, an increase well above the general rate of inflation. Nearly a third of employees in Germany say they are reaching their financial limits due to the significant rise in prices, and 21 percent say their salary is “rather not enough” to cover their current living costs.

Inflation is also being used again today to divide society and spread extreme political views, with the right-wing populist Alternative for Germany (AfD) using rising inflation to paint the current government and Europe in a bad light to win voters. Former AfD spokesman Christian Lüth even told a reporter, “The worse Germany is doing, the better it is for the AfD.” And the strategy of profiting from citizens’ fears seems to be working for the AfD: in surveys, almost 50 percent of AfD voters rate their own economic situation as poor—a significantly higher number than among voters of the other parties. Inflation is therefore not only an economic burden for the German population but also a source of social and political tension.

Lessons learned from the past

Unlike in 1920, however, this time the German government is trying to help its citizens as much as possible in these difficult economic times. The electricity and gas price brake is intended to protect citizens from the sharp rise in energy costs in Germany. In addition, students, employees, and pensioners could apply for a one-time support payment of up to 300 euros from the German government. Although public concern remains high, there also seems to be reason for optimism. The recent peak of inflation at 10 percent in September 2022, however, is nowhere near the level of the Weimar hyperinflation. “We are talking about high inflation today, higher than in my entire lifetime: 10 percent. That’s a lot, but in 1923 we’re talking about hyperinflation. That’s a whole different ballpark.” says Jutta Hoffritz, who studied economics and recently published a book on hyperinflation in Weimar. It should also be noted that the outlook for Germany is currently positive. The 10 percent inflation rate has subsided as German inflation eased to 3 percent in October 2023, its lowest level since August 2021.

Even though the Germans’ concerns and worries are deeply rooted in their history, there seem to be positive tendencies at the moment. It now remains to be seen whether this new inflation will shape another generation in Germany and further deepen the fear of currency devaluation or whether the less severe consequences of the inflation this time could change the discourse in Germany and finally put an end to the great fear of inflation.