Safe as Houses: Comparing Housing Finance Policies in the U.S. and Germany

Alexander Reisenbichler

Alexander Reisenbichler was a DAAD/AICGS Fellow in July and August 2014. He is a Ph.D. candidate in political science at the George Washington University, where his research centers on the political economy of housing, financial, and labor markets in advanced economies. His dissertation investigates the political economy of homeownership in the United States and Germany from a comparative, historical perspective. For this research, he has received fellowship awards and research grants from the Horowitz Foundation for Social Policy, the Free University Berlin’s Program for Advanced German and European Studies, and the Johns Hopkins University’s American Institute for Contemporary German Studies (AICGS). Mr. Reisenbichler has also been a visiting researcher at the Max Planck Institute for the Study of Societies in Cologne and the Hertie School of Governance in Berlin. His work has appeared in Politics & Society, the Review of International Political Economy, Foreign Affairs, and in several policy outlets.

He is a 2016-2017 participant in AICGS’ project “A German-American Dialogue of the Next Generation: Global Responsibility, Joint Engagement,” sponsored by the Transatlantik-Programm der Bundesrepublik Deutschland aus Mitteln des European Recovery Program (ERP) des Bundesministeriums für Wirtschaft und Energie (BMWi).

The recent financial crisis demonstrated that housing is a key sector of the U.S. economy, with the potential to bring down the entire global economy. The crisis also recast the debate on a distinct feature of the American political economy: the surprisingly vast presence of the American state in the housing sector. For decades, the federal government has subsidized the sector through housing finance policies such as tax breaks, mortgage market guarantees, and central bank programs. Today, these subsidies add up to impressive numbers. For instance, the country offered more than $121 billion in tax breaks to homeowners in 2013 alone[1]; the mortgage giants—Fannie Mae, Ginnie Mae, and Freddie Mac—are providing government guarantees in the secondary mortgage market that currently cover more than $5 trillion in mortgage-backed securities[2]; and the Federal Reserve (Fed) has provided about $1.7 trillion in monetary stimulus since 2008, specifically targeted at the housing market.[3]

Yet U.S. housing finance policies differ fundamentally from those of other countries. The common wisdom holds that the U.S., known as the “home of laissez faire,” is less likely to allocate resources through government programs than the social market economies of Europe, such as Germany. When it comes to housing, however, this conventional wisdom is turned on its head. Germany provides substantially fewer subsidies when compared with the U.S. This essay analyzes some puzzling differences between the housing finance policies of the two countries and explores some implications for today’s economies.

A Cross-National Snapshot

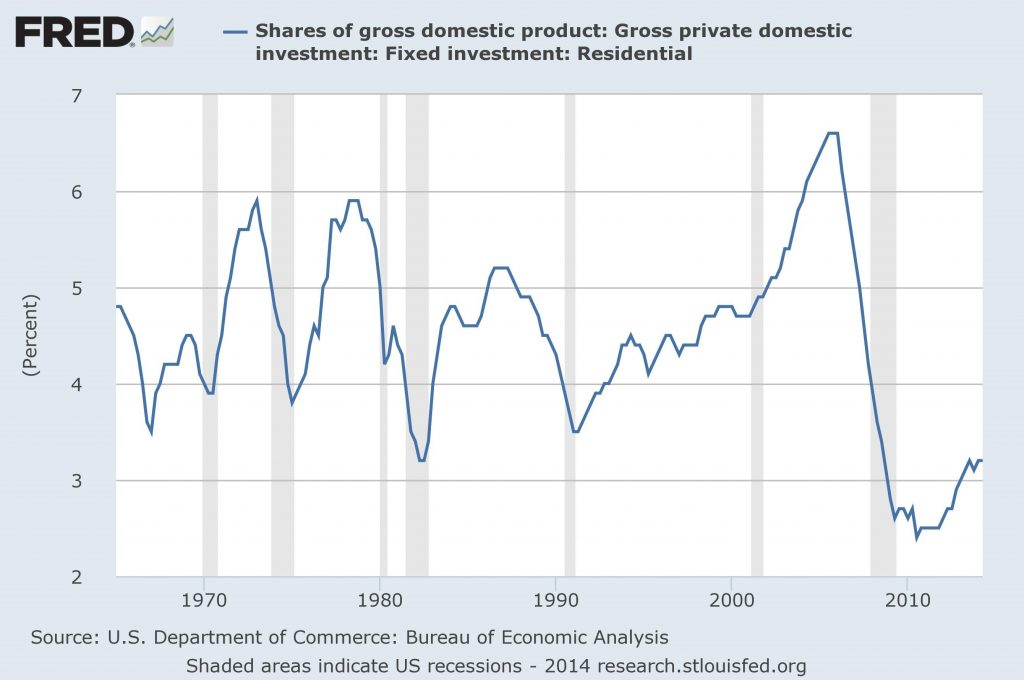

Housing finance policies differ significantly across countries. Figure 1 measures a country’s level of government support in the housing sector against its homeownership rate. Taking a cursory glance at the graph, the U.S. stands out in that it greatly subsidizes its housing market, whereas the UK, another archetypal liberal economy, subsidizes its housing sector to a much lesser degree.[4] The graph also reveals that both countries have comparable homeownership rates despite the stark variation in state support. Germany, a social market economy, lies closer to the UK for its level of government involvement, and it has an exceptionally low rate of homeownership (below 50 percent). Despite Germany’s label as a global economic powerhouse, most people in the country rent. Finally, homeownership in the U.S. is much lower than in other advanced countries, such as Belgium or Spain.

Figure 1: Government participation in housing markets in 2008.[5]

Tax Subsidies

One way for states to support the housing sector is through tax breaks to homeowners. In the U.S., there are three large housing tax breaks: the mortgage interest deduction, the property tax deduction, and the capital gains exclusion.[6] In contrast, the German tax code allows neither the deduction of mortgage interest and property taxes nor the exclusion of capital gains on the sale of homes.*

In the U.S., the origins of the mortgage interest and property deductions date back to 1913, when Congress introduced the federal income tax, and have been in place ever since. While the Tax Reform Act of 1986 provided a short window of opportunity for reform, as most tax deductions were on the chopping block, the Reagan administration and Congress quickly declared the mortgage interest and property tax deductions to be “sacred cows,” for largely political and economic reasons, much to the dismay of many technocrats in the U.S. Treasury.[7] More recent efforts to curb or reform the deductions, on the heels of severe budgetary pressures, have failed for the same reasons as they did thirty years ago: there is never a good time for reform given tight electoral cycles and the salience of the housing sector in every electoral district.

Time and again, economists emphasize that governments may adopt investment-neutral tax systems, without privileging certain sectors over others. This is because such tax breaks allocate resources into housing and budge investments away from other sectors; they encourage ordinary people to take on more mortgage debt; they tend to be inequitable (e.g., 86 percent of the mortgage interest deduction in the U.S. goes to the top 10 percent income bracket)[8]; and they are relatively ineffective in increasing homeownership (e.g., U.S. homeownership increased from 63 percent in 1965 to 69 percent in 2004 and fell to 65 percent in 2014).

However, what seems politically impossible in the U.S. occurred in Germany. The country eliminated its mortgage interest deduction along with other homeowner subsidies. Homebuyers in Germany were also able to deduct mortgage interest from their federal income taxes, but the country managed to eliminate the tax break in 1987 under Chancellor Helmut Kohl as part of the Residential Property Subsidies Act.[9] About a decade later, in 2006, the country also eliminated a large-scale subsidy program for homeowners (Eigenheimzulage), amounting to about €10 billion per year, whose origins date back to the late 1940s.[10] This sends a strong message to the U.S.: popular tax breaks and subsidies do not have to remain locked-in forever.

Quantitative Easing

Another way in which governments can subsidize the housing sector is through central bank programs. Central banks influence mortgage rates not only by setting interest rates, but also by unconventional policy measures such as large-scale asset purchases of mortgage-backed securities or covered bonds (commonly known as “quantitative easing”). This is because it is an effective way to lower mortgage rates and increase house prices. Since 2008, the Fed has purchased more than $1.7 trillion worth of mortgage-backed securities to directly support the housing market. While the European Central Bank (ECB) also conducted asset purchases of covered bonds in 2009 and 2011—some of which directly supported the housing market when the purchased bonds were backed by mortgages—the magnitude of these purchases was much less extensive, amounting to merely €100 billion.[11]

In the U.S., this practice dates back to the late 1960s, when Congress amended the Federal Reserve Act and authorized (and politically forced) the Fed to buy debt or securities issued by Fannie Mae. At that time, the Fed did not like the idea of fortifying a single market through monetary policy, which, in the words of then Fed Chairman William Martin, constituted “prostitution of the fundamental function of the central bank.”[12] However, the Fed eventually capitulated and bought relatively moderate amounts of Fannie Mae debt in the early 1970s.[13] Almost four decades later, when interest rates hit the zero-lower bound during the recent crisis, the Fed did not have second thoughts about buying large amounts of mortgage-backed securities. As the housing market was the source of financial distress and was perceived to have transmission effects into the wider economy, injecting liquidity into the housing sector was seen as an effective way to kill two birds with one stone.[14]

The ECB did not purchase assets to support European housing markets before the recent crisis (nor did the Bundesbank prior to the ECB), and when the ECB started its covered bond purchasing programs in 2009 and 2011, it only amounted to a fraction of the Fed’s purchases. Among other things, this is because the financial crisis in Europe had multiple core problems (e.g., sovereign debt, housing, and banking crises), along with different country interests. The ECB also could not easily rely on buying government-backed assets, as most European governments do not offer mortgage guarantees. Consequently, the ECB’s policy actions were decidedly more timid.[15]

Mortgage Market Guarantees

The third important way in which states can subsidize housing finance is through government guarantees in the mortgage market. The U.S. government has long provided explicit and implicit mortgage guarantees. The goal is to increase the mortgage lending of banks, since if lenders are guaranteed risk-free payments, they can offer mortgages at lower interest rates (although taxpayers remain on the hook in the case of default). In contrast, Germany has not offered public guarantee schemes for mortgages and has instead relied on private guarantee schemes. Again, these policy tools have deep historical origins, which have resulted in a more liquid mortgage lending market and contributed to higher levels of mortgage debt (about 80 percent of GDP in 2009) in the U.S. when compared with Germany (50 percent of GDP).[16]

Mortgage market guarantees in the U.S. originate in the Great Depression, when they were introduced to stimulate bank lending. Congress first established the Home Owners’ Loan Corporation in 1933, which temporarily purchased mortgages—short-term mortgages with variable interest rates and “balloon” payments—that were at risk of default and refinanced them into longer-term, amortizing mortgages, with fixed interest rates. Congress then established the Federal Housing Administration (FHA) in 1934, providing insurance for long-term (eventually 30-year), fixed-rate, amortizing mortgages. At this time, these mortgages became the standard in the U.S. Then, in 1938, Congress created Fannie Mae, whose function was to purchase FHA-insured mortgages from banks (after its privatization in 1968, Fannie could also buy private mortgage loans).[17] Fannie could then repackage these mortgages and sell them in the secondary market, with an implicit (pre-2008) or explicit (post-2008) guarantee against default. When Fannie Mae and its cousin, Freddie Mac, were placed into government conservatorship in 2008, this nationalized the secondary mortgage market, as almost all new mortgage-backed securities—the main source of mortgage finance—are issued with a government guarantee.

Mortgage lending functions very differently in Germany. In addition to bank deposits—Germany’s main source of mortgage funding—the country has used covered bonds (Pfandbriefe) to finance mortgage loans (i.e., bonds backed by a pool of mortgages). This practice was formally established under the Mortgage Bank Act in 1900, in order to finance urbanization, and has since remained in place. Yet, there are several key differences when compared with the U.S. system. The German government does not guarantee any mortgage loans, neither implicitly nor explicitly, and banks have to retain a significant proportion of covered assets on their balance sheets.[18] Standard mortgages in Germany have a fixed interest rate for only five to ten years with relatively high down payments (and strict underwriting standards). This might be because banks in Germany do not receive implicit or explicit government guarantees and borrowers face more complicated and stricter refinancing rules, which makes banks less likely to offer U.S.-style 30-year mortgages with fixed interest rates.

Two Different Growth Models

The cumulative and unintended result of these housing finance policies is a U.S. growth model that is based on housing finance and consumption, and one that is much less based on private housing consumption in Germany. The degree of housing subsidies in the U.S. is remarkable and directs investment into the owner-occupied housing sector away from the rental and other sectors. In Germany, there are fewer incentives to invest in owner-occupied housing and more incentives to invest in the rental market.

Increasing housing demand and prices are policy priorities in the U.S. The housing market’s share of the overall economy was roughly 16 percent in 2013, a sector significantly larger than manufacturing.[19] The sector is, moreover, deeply interlinked with other key sectors, such as the financial industries and construction, and has broad transmission effects into the larger economy. Increasing house prices, for instance, not only make homeowners feel wealthier, but also allow them to refinance mortgages and take out home equity to finance the consumption of additional services (e.g., health care, consumer goods, or business startups). The U.S. has a highly developed market for the extraction of home equity, which averaged $590 billion per year between 1991 and 2006.[20] It also encourages lending by banks, investments in housing-related instruments on Wall Street, and consumption. In short, the mindset is that if housing is humming along, the economy is in good shape.

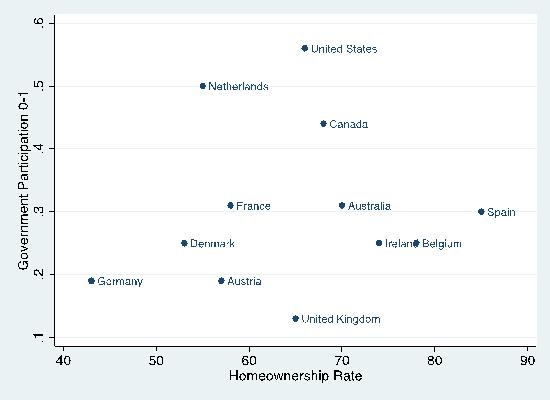

On the flip side, the growth model also makes the larger economy vulnerable to changes in the housing market and house prices. When housing demand and prices fall, this has negative transmission effects that affect the larger consumption-based economy, where overall consumption contributes 70 percent to GDP. All of that becomes even more problematic if the housing sector is the source of the reeling economy. Because of the recent housing crash—and despite massive state subsidies—the share of private residential investment fell from 6.5 percent to 2.5 percent of GDP (see Figure 2).[21]

Figure 2: Residential investment: Share of U.S. GDP, 1965-2014.

Without suffering from a similar crash, the German housing market contributes an impressive 19 percent to GDP.[22] Yet, the sector does not have the same transmission effects into the broader economy. First, house prices have nearly stagnated during recent decades and have only recently hiked because of Germany’s status as a “safe haven” during the euro crisis and record-low interest rates. Second, Germany has a more conservative mortgage market and does not have a market for extracting home equity, as banks’ attempts to offer such products have largely failed. Third, the country’s large rental market is functioning exceptionally well, providing fewer incentives to buy homes.

Contrary to the widespread belief that the German state operates large-scale public housing, the rental market is largely private (only 8 percent of all households live in social housing units compared with 19 percent in the UK).[23] While the origins of the rental market go back to the housing shortages after World War II and large-scale subsidized construction efforts, it has been incrementally privatized and liberalized over time, a market that is now very profitable for private investors despite strict tenant laws. Indeed, the German government provides incentives for the construction (and renovation) of rental buildings, both through subsidized loans offered by quasi-governmental banks to private investors or cooperatives (with certain conditions designed to ensure building standards and affordability) and longer depreciation allowances of rental buildings when compared with the U.S.

Whereas rising house prices are largely celebrated in the U.S., Germans view surging house prices with skepticism. This is because rising house prices translate into rising rental costs. As most people in the country rent, this is an important concern for policymakers. Given recent rent increases in major cities, this started a heated debate on whether to adopt a “rental break” (Mietpreisbremse). On top of that, a recent Bundesbank report sounded the alarm by highlighting recent house price increases, despite the country’s low level of mortgage debt and flat house prices in recent decades. In sum, there is a preoccupation with stability in the German housing market.

Larger Implications

Systems of housing finance can have important distributional consequences. When compared with Germany, the U.S. does not have a generous welfare state. Homeownership might therefore function as a “piggy bank,” meaning a form of private social insurance in times of welfare state erosion, pension cuts, and austerity, allowing ordinary people to save up money or to extract home equity to pay for health care bills. Although this approach has been rather uncommon in Germany, the country has also seen pension cuts and austerity in recent years. In times of record-low unemployment and interest rates, and now rising house prices, this might induce some more ordinary people to buy homes. It is even desirable to boost domestic consumption through household spending, for the reason that the German economy relies too heavily on exporting high value-added goods. The risk, of course, is that ordinary people might take on unsustainable levels of debt.

Relatedly, housing finance subsidies might also contribute to inequality. Subsidizing homeownership largely benefits the well-to-do—those who are able to climb the property ladder. This is also a central theme in Thomas Piketty’s book, in which he argues that housing contributed to growing asset inequality in the U.S.[24] In contrast, Germany has lower inequality levels, which might partly be explained by smaller disparities in housing wealth.

Finally, although commentators do not often characterize the American state as highly interventionist, the case of housing finance demonstrates that it is more interventionist than we often think. This is important because large-scale government support in housing finance has major distributional consequences for businesses, ordinary people, and the larger economy. Government intervention in housing finance in Germany, albeit different in nature and degree, has its own implications for ordinary people and markets. We should therefore view housing finance as a major area of the economy in which governments intervene—a factor largely neglected by commentators and scholars in social policy and economics.

Alexander Reisenbichler is a Ph.D. candidate in political science at the George Washington University and was a DAAD/AGI Fellow in July and August 2014.

[1] Joint Committee on Taxation, “Estimates of federal tax expenditures for fiscal years 2012-2017,” (February 2013).

[2] Housing Finance Policy Center, “Housing finance at a glance: A monthly chartbook,” Urban Institute (August 2014).

[3] Federal Reserve Economic Data (FRED), “Mortgage-backed securities held by the Federal Reserve,” Federal Reserve Bank of St. Louis (September 2014).

[4] Please note, for instance, that the recent “Help to Buy” scheme in the UK introduced mortgage guarantees and subsidies, which are not captured in this graph, but the scale of these measures is much smaller when compared with the U.S.

[5] The measure averages the following indicators: subsidies to first-time buyers; subsidies to buyers through savings account contributions; subsidies to selected groups; provident funds early withdrawal for house purchases; government guarantees or loans; tax breaks (i.e., mortgage interest and capital gains). See IMF, “Global financial stability report,” Washington, DC (April 2011).

[6] The mortgage interest deduction allows homeowners to deduct from their income the interest paid on home loans and is the largest housing tax expenditure. This tax break alone amounted to $69.7 billion in 2013. The property tax deduction, allowing homeowners to deduct their local and state property taxes from their federal income without limits, amounted to $27 billion in 2013. And the capital gains exclusion, by which homeowners do not have to pay capital gains taxes on the profits they make upon selling their homes, added up to $23.8 billion in 2013. See Joint Committee on Taxation (2013).

*Update, 2/23/16: German homeowners are exempt from paying a tax on capital gains if they have owned their home for at least three years before selling it.

[7] The same can be said about capital gains, which had been taxed until 1951, after which Congress allowed taxpayers to roll over the gains on the sale of the residence into another residence of equal or greater value. The capital gains tax break was then gradually extended until 1997, when Congress agreed to exempt from taxing the profits on the sale of primary homes up to $250,000 for singles and $500,000 for married couples.

[8] Benjamin Harris, Eugene Steuerle, Signe-Mary McKernan, Caleb Quakenbush, Caroline Ratcliffe, “Tax subsidies for asset development: An overview and distributional analysis,” Urban Institute & Brookings: Tax Policy Center (February 2014).

[9] It should be noted that until 1987, Germany had taxed imputed rent, something unimaginable in the U.S., a tax on the rental income that homeowners generate by living in their own home.

[10] Prior to 1996, the Eigenheimzulage used to be a tax break for homeowners, who could deduct some construction and purchase costs from their federal income for a period of eight years. It was then transformed into a direct subsidy in 1996.

[11] ECB, “Liquidity analysis,” https://www.ecb.europa.eu/mopo/liq/html/index.en.html#portfolios (accessed September 2014).

[12] “Martin scores plan to involve Reserve in home financing,” The New York Times (June 28, 1968).

[13] By 1977, the Fed held $3.3 billion in Fannie Mae debt, but it authorized its last purchase in 1981; and by the early 2000s, Fannie Mae debt had matured. See Renee Courtois Haltom and Robert Sharp, “The first time the Fed bought GSE debt,” Richmond Fed Economic Brief 14-04 (2014): 1-7.

[14] While the Fed will stop purchasing mortgage-backed securities in October 2014, already purchased securities are very likely to remain on the Fed’s balance sheet for quite some time until they mature.

[15] Please note that the ECB recently announced further purchases of asset-backed securities and covered bonds, the details of which are yet unknown.

[16] IMF, “Global financial stability report,” (April 2011).

[17] In the same year, Congress created Ginnie Mae to take over the securitization of mortgages issued by the FHA and the Veterans Administration. Soon thereafter, Congress created Freddie Mac, Fannie’s government-sponsored cousin, in 1970 to securitize mortgages issued by the savings and loan industry (Freddie, in fact, was owned by the thrift industry until 1989).

[18] Moreover, banks might only include up to 60 percent of the lending value of a mortgage into the covered bond pool, so as to protect investors in the case of falling house prices. Investors also enjoy preferential treatment in the case of bank insolvency, as covered assets are separated from other bank assets and are not part of insolvency proceedings.

[19] National Association of Homebuilders, “Housing’s Contribution to Gross Domestic Product (GDP),” (September 2014). The measure includes both residential investment and housing services.

[20] Alan Greenspan and James Kennedy, “Sources and uses of equity extracted from homes,” Oxford Review of Economic Policy 24.1 (2008): 120-144.

[21] The U.S. also introduced short-term measures to tackle the housing crisis: the Home Affordable Modification Program (HAMP) to restructure home loans with $26 billion; the National Mortgage Settlement Trust ($25 billion), for which the U.S. government negotiated settlements with banks, including debt forgiveness, as a result of banks’ wrongdoing before the crisis; a temporary tax break, known as Mortgage Debt Relief Act, that allows people to exempt from taxes income generated through debt forgiveness; the Home Affordable Refinance Program (HARP) that allows underwater homeowners to refinance their mortgages at lower rates; and the Home Affordable Foreclosure Alternative (HAFA) that facilitates short sales or deeds-in-lieu of foreclosure for banks and troubled homeowners.

[22] Wirtschaftsfaktor Immobilien (2013), http://www.iwkoeln.de/en/wissenschaft/veranstaltungen/beitrag/pressegespraech-wirtschaftsfaktor-immobilien-2013-130664 (accessed September 2014)

[23] See Eurostat, http://epp.eurostat.ec.europa.eu/statistics_explained/images/2/2a/Population_by_tenure_status%2C_2012_%281%29_%28%25_of_population%29_YB14_II.png (accessed September 2014).

[24] Thomas Piketty, Capital in the Twenty-First Century (Cambridge, MA: Harvard University Press, 2014).