White, Grey, and Black (Euro) Swans: Dealing with Transatlantic Financial Risk in 2012

The idea that the euro crisis is over is hopeful at best, naïve at worst. It is far from over. We are actually at the beginning of a dangerous new phase of political uncertainty across the eurozone that could massively impact its financial markets. On the other side of the Atlantic, continuing doubts surrounding the stability of Europe’s sovereign debt markets and its potential impact on a brittle U.S. recovery remains perhaps the single biggest threat to President Obama’s re-election bid in November. Even though, like the rest of us, the single currency enjoyed a relatively mild winter in January and February 2012, the spring months of April and May 2012 may well turn out to be the cruelest. Europe’s political calendar in the near future is an enormous volatility and uncertainty generator: the backlash against an extremely tough budget in Spain; high stakes presidential elections in France; politically lethal labor market reforms in Italy; a possible second bailout for Portugal; an Irish referendum on the new EU fiscal treaty; and Greece gearing up for an overdue parliamentary election. And as if that was not enough, there is also growing domestic opposition in Germany, the Netherlands, and Finland to doing anything more to buttress the existing institutional EU mechanisms to deal with the crisis.

On the surface, the euro situation looks better today than it did in the fall of 2011. Then, the euro seemed on the brink of collapse and democratically elected heads of government in both Athens and Rome were being replaced by unelected technocrats approved in Brussels and Frankfurt in order to stave off pending disaster.[1] Greece’s Lucas Papademos and Italy’s Mario Monti were hailed initially by the world’s financial markets as reliable stewards of their respective national economies and enjoyed their honeymoon periods with national publics who had grown increasingly disenfranchised with their inept political establishment. But it was not until the other Mario—Mario Draghi, the current president of the European Central Bank (ECB)—took a few pages out of Ben Bernanke’s playbook at the Federal Reserve around Christmas 2011 and introduced Europe’s backdoor equivalent of quantitative easing (QE)—the ECB’s Long Term Refinancing Operations (LTRO)—that the situation really began to improve and market confidence returned. Flush with half a trillion euros in cash (followed by another half a trillion in March 2012), European banks started to buy their respective countries’ bonds. Ten-year sovereign debt yields duly fell in Italy and Spain to more sustainable figures below 5 percent in January 2012. Greece completed a relatively successful restructuring of its sovereign debt in late February, with private bond holders taking a significant haircut, in return for a second EU-IMF bailout worth €130 billion. All this relatively good news allowed a confident Mario Draghi to declare that the worst was over during a press conference on March 22, even though (in fairness) he was quick to point out that many risks remained.[2]

How should policymakers on this side of the Atlantic think about the euro crisis and global financial risk today? A good starting point would be to return to the classic distinction between risk and uncertainty.[3] Both terms are often used interchangeably, but as we will see, doing so completely misses the mark. According to the Oxford English Dictionary (OED), “risk” means “the possibility of harm or damage causing financial loss, against which property or an individual may be insured.” It could also mean “the possibility of financial loss or failure as a quantifiable factor in evaluating the potential profit in a commercial enterprise or investment.”[4] The word “possibility” here is actually rather imprecise for the OED. Risk is only risk when it is “probabilistic” not “possibilistic” and, in principle, calculable. It would be hard to insure against risk if there were no probabilities attached. In fact, risk is a situation in which we actually know the probabilities or have pretty good reasons to think our estimates of them are good, which is why we can insure ourselves against loss in the first place.

Uncertainty, on the other hand, is defined by the OED as “the quality of being uncertain in respect of duration, continuance, occurrence, etc.” In other words, uncertainty is non-probabilistic. In addition, the OED terms uncertainty as “the quality of being indeterminate as to magnitude or value.”[5] Thus, uncertainty is a situation in which we cannot know the probabilities beforehand since there is no way to estimate them. Consequently, there is no way we can insure ourselves against losses in such an environment. In a world where we are predominantly dealing with risk, roulette tables in Las Vegas, life insurance in Miami, we know that past observations are relatively reliable predictors for future events. However, in an uncertain world, such knowable bets are off since there is very little the past can teach us about the future. University of Chicago’s Frank Knight already made the distinction in the 1920s, as did John Maynard Keynes in the 1930s.[6]

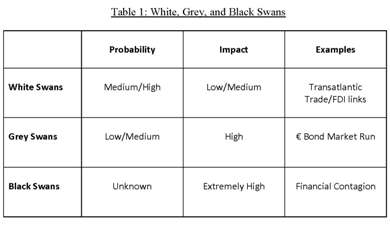

In order to make sense of transatlantic risk and uncertainty, I am going to build on the “black swan” concept developed by Nassim Nicholas Taleb, who used the metaphor of the Black Swan (all swans were white until one was found that was not) to illustrate what he calls “the impact of the highly improbable.” I will use his concept to explain the economic and financial threats facing the transatlantic economy today with three kinds of “euro swans”: white swans, grey swans, and black swans.[7]

First, white swans are events which present us with economic or financial “risk.” There is a knowable probability of them occurring—such as a eurozone recession, a further drop in the euro-dollar exchange rate, or a deterioration in German consumer and business confidence—but in the end, they will have a relatively low impact on the U.S. economy. At least, U.S. economic policymakers and individual market participants can hedge themselves against the detrimental impact of white swans since they are in principle knowable in advance of their occurrence.

Second, grey swans shade from risk toward uncertainty but flit between the two. They are less likely to happen than white swans, or at least the probability that they could be estimated accurately is lower, but they could potentially have a much higher impact on the U.S. economy. Here we are dealing with political events where we can be relatively certain the financial fallout can be limited, but we can never know for sure. The failure of a major European bank spreading Lehman-like contagion is in principle knowable as a probability. How much damage it would do given the interdependencies of derivatives and cross border bank liabilities is not.

Third, black swans are those surprising events that have a completely unknown probability, and thus are absolutely uncertain, but we know with certainty that the impact will be devastating.[8] In this last instance, we face highly uncertain political events that could lead to full-blown financial market contagion, with dramatic consequences for the U.S. and world economy. In this case, political responses will simply be too late to limit the initial fallout. Table 1 below summarizes the three potential swan impacts.

White swans are the easiest to deal with, since they are relatively easy to anticipate, and insurance is possible. There are three channels of transatlantic economic integration which will be negatively affected by the continuation of the euro crisis. These are: U.S.-European trade, European foreign direct investment in the U.S., and corporate earnings from U.S. multinational corporations in Europe.

As Daniel Hamilton and Joseph Quinlan have pointed out in The Transatlantic Economy 2012, about one fifth of total U.S. exports currently go to the European Union.[9] Hamilton and Quinlan observed an expansion of U.S. exports to Europe by 13.1 percent in the first eleven months of 2011, but noticed a visible slowdown in growth at the end of 2011.[10] With exports a key growth engine of the American recovery and a real risk that the downward trend would be exacerbated by white swan events, the impact to the U.S. economy will be both real and insurable. A second channel of euro crisis transmission is via the corporate earnings of U.S. multinationals that are operating in Europe. Given that Europe has been the recipient of the lion’s share of American FDI in the past, U.S. corporate earnings will take a hit if the eurozone slides deeper into recession. To illustrate the magnitude of U.S. corporate earnings in the EU, net income of U.S. foreign affiliates in Europe in 2009 was almost $480 billion, or almost 60 percent of their total net income abroad.[11] The last channel is the likelihood of substantial foreign direct ‘disinvestment’ of European multinational companies in the United States. Hamilton and Quinlan point out that European FDI inflows into the U.S. declined by 28 percent during the first three quarters of 2011. They note that the decline was a “reflection of troubled times in Europe [rather] than of unfavorable dynamics in the United States.”[12]

Of course, in all three channels—trade, corporate earnings, and FDI—American firms and U.S. policymakers can hedge themselves to some extent. Exporting firms can focus their sales more on growth markets like Brazil, China, and India, so even if exports to Europe were to actually start declining in 2012, the impact on the U.S. economy might be contained. U.S. multinationals can also re-balance their international earnings portfolio somewhat, while American policymakers could focus on attracting FDI from sources other than the European Union for the time being. But all that being said, there is still likely to be a negative impact, even though it might be contained (low/medium impact with a medium/high probability).

It gets more complicated—and much more uncertain—with grey swans. Grey swans happen when political events, of which we know the actual timing, have uncertain outcomes that may trigger renewed volatility in the financial markets. In the case of an intensification of the European credit crunch, the ECB could always (and will likely) intervene more, but given the growing opposition to the ECB’s role in the crisis, we can no longer take that for granted. Given the close linkages between European and American banks, and the intertwining of European and U.S. stock markets, the impact on the U.S. economy could be high and hard to discern in advance of the event.

Three grey swans will be swimming down the river in April and May 2012. First, there are the French presidential elections on April 22 (first round) and May 6 (second round). The latest polls put the incumbent Nicolas Sarkozy (with 28 percent) slightly ahead of his main socialist challenger François Hollande (with 27 percent) in the first round, but they find Hollande well ahead of Sarkozy in the second round, with 54 percent against 46 percent.[13] Since Hollande has made a big point during the campaign of wanting to renegotiate the EU’s new fiscal treaty, there will likely be a negative response in the bond markets on May 7 in the event of an Hollande victory. Second, there are the long anticipated parliamentary elections in Greece, for which no date has formally been set, but most political analysts put the most likely dates on April 29 or May 6. Opinion polls in Greece have varied, but right now the most likely outcome will be that no single party will end up with a workable majority in parliament, and long coalition negotiations could jeopardize the continuation of austerity policies on which EU bailout money depends.[14] Third, there is the Irish referendum on the EU fiscal treaty, which will be held on May 31. Current polls suggest a likely ‘yes’ vote, but given several past ‘no’ votes on Europe in Ireland, those figures can hardly be counted upon. Another Irish ‘no’ would renew financial market fears about the sustainability of Europe’s sovereign debt. All three events hold serious political risks (high impact), but the precise transmission mechanism to financial markets and the relative impact of these events is quite uncertain (even though the probability is relatively low).

But we should worry most about the last swan category. Black swans are surprising political events—of which the timing is unknown and completely unanticipated—and one of the likely consequences could be full-blown financial contagion across the Atlantic. Those black swan events have no historical precedents, no set date, and there are no polling data we can consult. They consist, in this instance, of political experiments in democracies of which we cannot know the outcome.

There are a few serious candidates for such black swan events in Europe right now. First is the potential backlash against Mario Monti’s labor market reforms, which will make it easier to hire and fire employees in Italy. The last time an Italian government was serious about abolishing the infamous Articolo Diciotto (Article 18) of the country’s labor code, Marco Biagi—a labor law professor from Bologna who was advising the Berlusconi government on changing the legislation—was assassinated by a splinter group of the leftwing Red Brigades in 2002, and the whole effort was aborted. Monti’s approval ratings recently fell from 62 percent in February to 44 percent in March, underscoring the end of his honeymoon.[15] The politics of labor market reform in Italy are poisonous and the political fallout of pushing such legislation through parliament is simply unpredictable.

Next there is Spain’s “most austere budget of the post-Franco era” prepared by the new Partido Popular government led by Mariano Rajoy.[16] Combining €27.3 billion of budget cuts and tax rises with a freeze on public sector pay, the Rajoy government is trying to deflect criticism from the European Commission on how large their deficit for 2012 could be. But there are also Greece’s seemingly never ending draconian austerity measures, currently implemented by unelected technocrat Papademos. Both Greece and Spain are relatively young democracies that have experienced thirty years of economic growth and prosperity since their transition from autocratic rule. There are no precedents for how citizens in both countries will respond to the steep decline in their standards of living (Greece currently has 30 percent of the population below the poverty line) especially when things will only get worse in the short term. Furthermore, there is the domestic political situation in Germany with growing opposition against what is being seen as a “transfer union” EU, the looming threat of its constitutional court against ceding more sovereignty to the European level, combined with the increasingly loud German dissent on the governing board of the ECB when it comes to its liquidity operations.

And there is one final black swan to consider. If the definition of the black swan is a high impact event of unknown probability, then perhaps the biggest one of all are the financial markets themselves: they can have an extremely high impact, but their probability is unknown, and therefore they are highly uncertain. On the one hand they crave austerity and regard deviation from debt reduction as heresy. Yet they also want growth. Reducing debt while other states are doing the same thing increases the total debt load. This has been the story of Europe since 2009. All those states who undertook austerity to reduce debt, from Greece to the United Kingdom, now have bigger debts than ever. Markets that want two simultaneously unattainable things at the same time are the very definition of an uncertainty generator.

What all the potential situations outlined above have in common is that they are “unknown unknowns,” to use Donald Rumsfeld’s typology. We do not know the timing and we do not know the response from the financial markets (unknown probability). We also cannot insure ourselves against it, since we cannot know how all the other financial market players will respond when such events occur. It is also unlikely that policy responses trying to calm the markets will be fast and comprehensive enough (extremely high impact).

We can conclude that dealing with uncertainty is infinitely more challenging for policymakers than dealing with risk. The United States can deal relatively well with white swan events. They are mainly risk situations against which certain insurance mechanisms exist, and the negative consequences can most likely be contained. However, there is no good way ex ante to deal with grey and black swan events. There is very little policymakers can do to prevent black swans, like the popular uprisings of the Arab Spring or the London riots of 2011. In many ways, we are more in a grey swan situation right now: we know we have several political events that are about to hit us with high likely impacts. We are just not sure how it is actually going to play out. But then, the very nature of uncertainty means that there is no good insurance policy. So long as EU policymakers keep insisting on a one-sided narrative of the euro crisis (i.e., “It’s all fiscal”) and hence offer only one-sided solutions (“Austerity, so help us God”), the uncertainty surrounding European sovereign debt markets is unlikely to turn into calculable risk.

Dr. Matthias Matthijs is Assistant Professor of International Economic Relations at American University’s School of International Service (SIS) and a Professorial Lecturer in International Economics and International Relations at Johns Hopkins University’s School of Advanced International Studies (SAIS).

[1] See M. Matthijs and M. Blyth, “Why Only Germany Can Fix the Euro,” Foreign Affairs, 17 November 2011. Online available at: http://www.foreignaffairs.com/print/133968

[2] “ECB’s Draghi says worst of euro zone crisis over,” Reuters, 22 March 2012. Online available at: http://in.reuters.com/article/2012/03/21/ecb-draghi-idINDEE82K0I720120321

[3] See M. Blyth, “Great Punctuations: Prediction, Randomness, and the Evolution of Comparative Political Science,” American Political Science Review 100 (4), November 2006, pp. 493-498

[4] Oxford English Dictionary, “Risk.” Online available at: http://www.oed.com/view/Entry/166306?p=emailAOgqLTUipW4uk&d=166306

[5] Oxford English Dictionary, “Uncertainty.” Online available at: http://www.oed.com/viewdictionaryentry/Entry/210212?p=emailAOqNRGrl9LiGc&d=210212

[6] See Blyth, “Great Punctuations,” p. 495

[7] N. Taleb, The Black Swan: The Impact of the Highly Improbable (New York: Random House, 2007)

[8] Good black swan examples are the popular uprisings of the Arab Spring, or the London riots of August 2011.

[9] D. Hamilton and J. Quinlan, The Transatlantic Economy 2012: Annual Survey of Jobs, Trade and Investment between the United States and Europe (Washington, DC: Center of Transatlantic Relations, 2012), p. 5

[10] Ibid.

[11] Ibid., p. 6

[12] Ibid., p. 12

[13] J.-B. Garat, “L’ecart se ressert encore entre Sarkozy et Hollande,” Le Figaro, March 27, 2012. Online available at : http://www.lefigaro.fr/politique/2012/03/27/01002-20120327ARTFIG00611-l-ecart-se-resserre-encore-entre-sarkozy-et-hollande.php

[14] M. Petrakis, “Greek Election Gridlock Risks Derailing Rescue,” Bloomberg Businessweek, 28 March 2012. Online available at: http://www.businessweek.com/news/2012-03-28/greece-bailout-seen-in-debt-with-junk-grade-euro-credit

[15] Euro Intelligence, “The Monti honeymoon is over,” Daily Briefing, 23 March 2012. Online available at: http://www.eurointelligence.com/eurointelligence-news/home/singleview-restricted/article/the-monti-honeymoon-is-over.html

[16] M. Johnson, “Spain unveils new austerity measures,” Financial Times, 31 March 2012. Online available at: http://www.ft.com/intl/cms/s/0/285b2682-7a58-11e1-839f-00144feab49a.html#axzz1qsH2nFJE