Overcoming the Euro Crisis

Paul J.J. Welfens

European Institute for International Economic Relations

Prof. Dr. Paul J.J. Welfens was a Geoeconomics Non-Resident Senior Fellow at AICGS. He was Jean Monnet Professor for European Economic Integration; chair for Macroeconomics; president of the European Institute for International Economic Relations (EIIW) at the University of Wuppertal; Alfred Grosser Professorship 2007/08, Sciences Po, Paris; and Research Fellow, IZA, Bonn.

The euro crisis has come to a preliminary halt following the two massive liquidity injections by the European Central Bank (ECB) in December 2011 and February 2012. However, these ECB interventions and the double haircut for private bondholders of Greek debt have not brought sustained stability. Moreover, the new Fiscal Compact adopted in December 2011 by twenty-five European Union (EU) countries is not a convincing remedy for the problems of the euro area. Indeed, the euro summit diplomacy of 2011-2012 has largely been inconsistent and the institutional limbo of the Economic and Monetary Union calls for broader reforms. This essay highlights the policy pitfalls of the euro summit diplomacy and crisis management, discusses the key issues facing the euro area and transatlantic relations, and points to the need to switch to a Euro Political Union.

After two years of severe euro crisis—with Greece and Ireland facing serious debt financing problems in 2010-2011 and Portugal also fleeing under the EU/IMF rescue umbrella—international capital markets have temporarily calmed. Two major liquidity injections by the European Central Bank in December 2011 and February 2012 have contributed to restoring some stability in the euro area. Banks in many euro area countries, particularly in the crisis countries, have received some €1.1 trillion through the three-year long term refinancing operation (LTRO) of the ECB, which has stabilized the banking sector in these countries. Part of this liquidity was also used to buy new government bonds with medium-term maturity since it is highly profitable to take up ECB liquidity at an interest rate of 1 percent and to invest it in medium-term bonds of Spain, Italy, Ireland, or Portugal, which carry interest rates of around 4 percent. The basic assumption here is that there will be no further haircuts along the Greek model, which has made international financial markets very nervous.

Germany’s output decline in the Great Depression was 16 percent. Given the expected election victory of the radical parties in Greece many observers expect that a new government would no longer honor the agreements concluded with euro partner countries and the IMF and this would mean that no further disbursements from rescue funds will take place and that Greece will face disorderly bankruptcy and a forced return to the Drachma. In this case there is a high likelihood that a few weeks later Cyprus will also be bankrupt and then need an IMF program and support by euro partner countries. Moreover, there will be a strong rise of the interest rate of Italy, Spain, Portugal, and Ireland—this could only be avoided if the ECB were willing to buy bonds from these countries in large amounts. This is absolutely not welcome by the German government.

Portugal was the first country with an excessive deficit procedure in 2002 and it has pursued an unsustainable economic policy since then as high government budget deficits were combined with a high current account deficit-GDP ratio so that Portugal’s sovereign debt financing was relying more and more on international investors. However, after the shock of the bankruptcy of the American investment bank Lehman Brothers on 15 September 2008, the risk premiums of international investors have steeply increased and attracting foreign capital inflows required higher interest rates, particularly when the leading rating companies declared the downgrading of the respective country. The new conservative government, which took over in Portugal in 2011, has tried to impose an austerity policy on the country and it seems that the deficit-GDP ratio can successfully be trimmed. However, the current account-GDP ratio was still negative in 2011 and certainly Portugal continues to face problems in international competitiveness.

Ireland’s problems have only partly been solved through the adjustment program adopted by the new government. The previous government had not implemented EU prudential supervision rules and Irish banks thus incurred enormous excessive risk in their aggressive expansion strategies that included real estate projects and investment in structured financial products. Ireland’s deficit-GDP ratio in 2010 was 31 percent, of which two-thirds reflected costs for saving the banks. Ireland’s gross debt-GDP ratio increased from 44.2 percent in 2008 to 92.5 percent in 2010 and is expected to peak at 118.6 percent in 2013.[1] The implicit interest rate, which had fallen from 5.3 percent in 2008 to 3.6 percent in 2011, will rise to 5.2 percent in 2013 so that government has to increase direct income taxes that are expected to increase from 10.6 percent in 2009 to 13.2 percent in 2015.[2]

While Ireland has made some progress, including a strong improvement of the current account position, the adjustment progress in Portugal is more difficult; moreover, Portugal’s economy is potentially exposed to adverse shocks from Spain. The situation in Greece looks rather unstable as long as there is no return to sustained economic growth. The interaction of Spain’s market confidence problems and the debt dynamics in high debt countries—such as Italy, Greece, Portugal, and Ireland—might lead to a critical situation once that negative external shocks hit the euro area or major individual countries. However, the peak of the debt-GDP ratio in all euro area countries should be over by 2013, except for the special case of Greece. If the world economy shows sustained economic growth one may anticipate that the degree of euro area instability can be reduced, however, the problem to bring the debt-GDP ratios of euro countries back toward the 60 percent limit remains. This issue has been raised by the German Council of Economic Advisers,[3] which has proposed a special joint fund of euro area countries that would allocate the excessive part of the respective national debt to this fund so that after 24 years this fund could be resolved, as countries have repaid the excessive part of the debt. While 24 years is a relatively long time horizon, which raises problems of policy credibility, one may nevertheless consider this interesting proposal. However, in the first round one could consider a 75 percent level of debt-GDP as acceptable so that the necessary time for repayments and joint guarantees is shortened—say to a period of about 15 years.

The Euro Crisis Unfolds

In 2007, the economic dynamics in the EU looked favorable. In 2008, the IMF’s report[4] on Greece forecast that the debt-GDP ratio would fall to 72 percent in 2013; under adverse conditions (2 percent growth per year), the ratio would reach 96 percent. In reality, the Greek debt-GDP ratio would reach about 170 percent in 2013, if not for the haircut on private creditors that has reduced the debt-GDP ratio so drastically. Also noteworthy, the IMF published a Financial Sector Assessment Program (FSAP report) on the financial system and banking system of Ireland in July 2006, stating that there were no problems in the banking sector, and only in insurance and reinsurance did there seem to be some challenges. Rarely have IMF reports been so misleading. One may argue that the IMF indirectly contributed to the euro crisis due to the poor analytical reports on Greece and Ireland; incidentally, the FSAP report on Switzerland was also characterized by major misperceptions.

The sharp haircut solution for Greece is surprising and questionable. According to IMF figures from December 2010, Greek government assets clearly exceeded government debt but the government was not pressured to privatize its assets in 2010-2011 in exchange for EU/IMF rescue packages. This is very much in contrast to the privatization efforts that were undertaken in eastern European EU countries. In post-socialist eastern European countries, privatization was considered not only as a basis for additional government revenues, but also as part of overall structural reforms and steps toward raising factory productivity and per capita income.

In Greece, the combined privatization revenues from 2010 to 2011 was less than 2 percent of the overall estimated government gross asset position of about €400 billion.[5] The EU summit’s approach to the sorting out of the Greek debt problems certainly has raised the issue of how big the haircut will be in other countries facing a major debt crisis. A higher long term risk premium for countries such as Italy and Spain is a likely side effect of the Greek haircut decisions. While eastern European EU countries privatized whole economies in the 1990s, the Greek government seems unable or unwilling to embark even on a small-scale privatization. The Greek government’s assets are large enough to consider the option of mass privatization, which would be useful for overcoming resistance among certain groups in Greek society to privatization. Even after imposing a haircut on Greek creditors, which has wiped out almost 30 percent of the public debt, the situation in Greece is still rather unstable. The broader debt dynamics in OECD countries are certainly also unfavorable for highly indebted small countries with high foreign indebtedness.

Across the Atlantic, the U.S. lost its AAA rating from Standard & Poor’s in 2011. This was, however, a rather questionable decision since the reasons given by S&P are inconsistent. Since the U.S. rating is a natural benchmark for all OECD countries, the downgrading of the U.S. government debt has cast a shadow over the ratings of almost all OECD partner countries. On the other hand, as of spring 2012 Germany still had a AAA rating from all the leading global rating agencies. Moreover, Germany’s economic growth benefits from the safe haven effect estimated by the Deutsche Bundesbank[6] to be around 2 percentage points. Hence Germany’s government was able to place government bonds with 10 year maturity at slightly less than 2 percent in early 2012, implying that the real interest rate—calculated as nominal interest rate minus consumer price inflation—is negative. This is quite unusual for the German economy. The economic benefits that Germany gets from the safe haven effect are considerable and will be analyzed in more detail subsequently.

Germany is a key player in the Greek crisis. It has a share of 29 percent in the European Financial Stability Facility (EFSF), the temporary rescue umbrella for stabilizing euro crisis countries. The first €110 billion loan for Greece from spring 2010 was created as a package of bilateral credits; however, further packages for Ireland, Portugal, and then Greece II—in 2012—were taken from the EFSF. In Germany a broad discussion has started about the risks and costs of rescuing operations for Greece, Ireland, and Portugal.

Many politicians and certainly ordinary people are afraid of the high risks Germany faces as a consequence of putting up several European euro rescue funds and buying troubled government bonds.[7] The overall amount of bonds bought by the ECB by the end of 2011 was about 3 percent of the euro area’s gross domestic product—miniscule compared to the massive Quantitative Easing (QE) operations by the Bank of England and the U.S. Federal Reserve in 2009-2011 when government bonds of about 20 percent and 15 percent, respectively, were bought by the two central banks.

Internal and External Imbalances

The EU has developed a set of ten indicators, which are assumed to reflect potential problems with internal or external imbalances. Internal equilibrium normally can be defined simply by full employment; however, in an open economy there might be reasons to also consider additional aspects. Indeed, a real estate bubble could be a special form of internal disequilibrium—although it might be connected to similar bubbles in other countries where the broadening of the collateral basis for real estate loans might trigger international capital outflows. These outflows in turn amount to an injection of liquidity in foreign real estate markets which then could face bubbly dynamics as a new problem. Alternatively, the real estate bubble could have its roots in domestic policy measures; e.g., very loose monetary policy.

The European Commission’s consideration of internal and external equilibrium for each euro member country is somewhat surprising. Basically, external equilibrium may be defined only for the overall euro area (there is no need to define external equilibrium in the U.S. with respect to individual states). This already demonstrates that even the euro area has a problem in the sense that it is not a political union. If it was a political union and had fully integrated markets, any major problem in the banking system of one of the member countries simply would trigger takeovers by the prosperous and profitable banks. In the euro area, however, financial markets and banking markets have become fragmented after the transatlantic banking crisis, which has created much mistrust among banks. The lack of confidence in the banking market is clearly visible in the large excess liquidity positions held by many banks from many countries at the ECB—even at very low interest rate of .25 percent, banks from euro area countries hold about €800 billion in excess reserves at the ECB in spring 2012.

Regarding macroeconomic imbalances across countries, the European Commission takes a differentiated view; a report by the Commission concludes:

“The adjustment of external imbalances and the repair of household and corporate balance sheets have been rather painful, particularly in Member States which experienced large imbalances prior to the crisis. This adjustment has been largely driven by the developments in domestic demand, and has often been associated with a significant rise in unemployment levels. This may reflect limited price/wage adjustment but could also reflect the ongoing process of sectoral reallocation. The adjustment to macroeconomic imbalances often requires shifts of labor and capital across different sectors in the economy, in particular from artificially inflated real estate sectors to tradable sectors. This process is usually gradual (given the different skill requirements of the sector concerned) and has still some way to go.”[8]

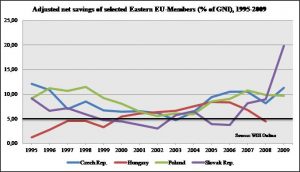

As regards indicators of economic decline one may point out the adjusted net savings ratio (that is, expenditures on education are added to the normal savings rate and natural resource depletion is included in a broader term of depreciations) is a useful indicator as shown in the subsequent graphs where early on problems in Hungary, Greece, Spain, and Portugal as well as in the U.S. can be seen. A strong decline of this adjusted net savings ratio indicates that output growth will fall in the medium term and this in turn has a negative effect on the solvency of the respective country (the net savings rate combined with the share of renewable energy and the relative position in the field of the export of environmental friendly products is the basis of a new global sustainability indicator developed.[9]

Figure 1: Adjusted Net Savings Rate of Selected Countries

Tax Dynamics and Interest Payment Aspects

In the euro area there is a clear link between the ratio of government interest payments to GDP and the average tax rate. If that ratio is rising strongly—be it that the debt-GDP ratio is rising or the interest rate is raised—government will have to impose higher taxes. Tax hikes basically can come under the form of higher income tax rates or higher value-added tax (VAT) rates. Higher VAT rates typically stimulate net exports of goods and services since a higher VAT rate discourages domestic demand. In a small open economy, therefore, the difference between production and domestic demand is falling and an improvement of the current account position is the natural by-product. If governments want to stimulate economic growth in an environment with rising tax rates it would be advisable to impose mainly higher VAT rates and to possibly even reduce the income tax rate—and the corporate tax rate. In the subsequent table it is noticeable that the ratio of government interest payments to GDP has declined in many countries in 1998-2007—the period between the start of the euro area and the collapse of Lehman Brothers. However, in the period 2007-2013 there is a strong rise of the ratio of government interest payments to GDP. Such a rise typically will go along with a higher income tax rate, but a higher income tax rate is likely to undermine economic growth in the medium term.

Table 1: Ratio of Government Interest Payments to GDP (in %)

Source: AMECO Database

Poor Crisis Management and the New Role of the ECB

The idea of the euro/EU summit to push for early private sector involvement in the Greek crisis is quite questionable. With estimated government assets of around €400 billion and a debt of about €360 billion, the Greek government should not have solvency problems provided that leading actors in the political system—or other groups—are not blocking privatization.

The main effect of the imposed haircut of 21 percent at the summit on 21 August 2011 was to trigger massive wealth losses in Europe and worldwide: If investors translated this haircut for Greece into an expected 20 percent haircut for Italy, a loss of €360 billion (Italian debt was about €1.8 trillion in summer 2011) and another €140 billion loss for Spain (with a public debt of €700 billion) ensues. It is a strange political rescue operation for Greece that generates about €35 billion in cutting public debt, while paying the price of wealth losses of some €500 billion. The equation looks even more bizarre if one considers the 50 percent haircut decision of October 2011. The euro summit dynamics exhibited poor crisis management. It also was not wise to undermine the role of the European Commission since the over-emphasis on euro summit politics naturally brought a strong focus on the role of the dominating countries, Germany and France. This was bound to trigger some anti-German and anti-French sentiment in crisis countries. Had the same decisions been made by the European Commission, the people in the crisis countries still would not have welcomed the adjustment programs, but there would have been broader acceptance as the European Commission stands for a broader community.

The European Central Bank maintains a positive reputation in the Community. By contrast, the European Council has suffered from its handling of the Greek haircut in which the rate suggested was changed dramatically within less than six months. The European Central Bank has achieved a very low inflation rate in the first decade—close to 2 percent—and jointly with national governments of euro area countries has helped to contribute to overcoming the transatlantic banking crisis of 2007-2008.

The U.S., which had been the epicenter of this crisis, has also been rather successful in overcoming the banking crisis. However, U.S. monetary policy strategy has been different from the ECB’s policy, which mainly relied on cutting the interest rate to a very low level while not adopting a quantitative easing policy like that of the U.S. The euro crisis almost immediately followed the transatlantic banking crisis and did not come as a surprise, considering the number of highly indebted countries facing sudden problems of debt refinancing, as already pointed out in October 2008.[10]

The ECB adopted a rather new role under Bank president Mario Draghi when it injected more than €1 trillion into the euro area’s banking system within three year liquidity operations in December 2011 and February 2012. These unusually long term liquidity injections offered at an interest rate of only 1 percent imply that banks, particularly from countries such as Greece, Ireland, Portugal, Spain, and Italy, have access to liquidity at favorable conditions. Even banks that have lost access to the interbank market—this market dried out largely in 2011 and thus continental Europe faces similar problems as in the transatlantic crisis of 2008-2009—can get access to liquidity; certainly many banks have used the extra ECB liquidity to buy medium-term government bonds and to thereby make a nice profit. From this perspective the ECB liquidity injections are not only indirectly helping governments to finance deficits and to refinance the existing stock of debt. The ECB liquidity injections are also undermining the normal consolidation process in the banking system. The normal winners in the euro area banking markets, namely banks from Germany, France, the Netherlands, Luxembourg, and a few other countries, are no longer in a position to easily take over foreign rivals in the EU single market. To the extent that ECB liquidity injections undermine competition in the banking market of the EU single market, there are considerable negative side effects to the central bank intervention. From this perspective the alternative strategy of quantitative easing embraced in the U.S. and the UK is preferable, although other problems are associated with this type of intervention. With quantitative easing—implementing a gigantic expansive open market operation, as was the case in the UK in 2009-2011 and in the U.S. in 2010-2011—there is some risk that inflation could increase in the medium term (as in the UK) or in the long term.

Strategic Issues in the EU and the Euro Area

For the stabilization of the euro area it will be crucial to stabilize the three small economies in crisis that had to seek the financial support of the IMF and the EU in 2010-2011. The progress made in Greece is rather modest so far.[11]

Portugal has made considerable progress in 2011[12]; however, the insightful analysis of a German group of research institutes suggests that the debt-GDP ratio of Portugal is bound to rise for many years.[13] The public debt situation might, however, become less dramatic if the current account deficit could be switched into a solid medium-term current account surplus; in such a changed setting government would rely less on foreign savings and more on domestic savings to refinance the current debt. With respect to Ireland one may expect some gradual improvement after 2013-2014 when the expected debt-GDP ratio will peak, but it will take Ireland many years to move back to sustain itself and achieve high economic growth. There are still serious problems in the banking sector and the reallocation of resources occurs only with considerable adjustment costs. Moreover, the direct tax-income ratio has increased.[14]

Safe Haven Effects in Germany

The Deutsche Bundesbank pointed out that the safe haven effect amounts to roughly 2 percentage points[15]; high capital inflows, triggered by the euro crisis, are attracted to Germany so that the nominal and real interest rate on government bonds is falling. Consequently, the cost of capital for firms also will fall, probably by only a fraction of the reduction of the government bond yield (say 50 percent). A decline in capital costs will bring about an increase of the investment-GDP ratio and this in turn will raise real income and employment, thereby weakening the current account and raise tax revenues and reducing the deficit-GDP ratio. A direct effect of a decline in interest rates is the devaluation of the exchange rate, and this assumes that considerable part of higher capital inflows are from non-EU countries. How large could the impact of the safe-haven effect be? In 2011 the German GDP was €2.571 trillion and it is assumed here that in 2017 GDP will be €2.9 trillion. Assuming that the safe haven effect would raise GDP by a small increase in 2010, but by 0.5 percent in 2017 the German GDP will be €2.914 trillion. As taxes and social security contributions are 40 percent of GDP the implication is that government will have additional revenues of almost €6 billion (compared to the baseline scenario). Based on the average maturity of German debt of seven to eight years, the safe haven effect will feed into the total debt over the period 2010-2017. This means that government in 2017—based on total debt of €2.2 trillion—will record a reduction of interest payments by €44 billion. Along with the additional tax revenues and social security contribution and reduced expenditures on unemployment, this implies that government benefits from a safe haven effect of about €50 billion. Assuming that the safe haven benefit of government is €10 billion in 2010, €15 billion in 2011, €20 billion in 2012, €25 billion in 2013, €30 billion in 2014, €35 billion in 2015, €40 billion in 2016, and €50 billion in 2017, the accumulated benefit is €225 billion, which is 8 percent of the GDP of 2017. Even if the losses from the euro security umbrellas (EFSF, ESM, and the first rescue package for Greece) would reach €50 billion, the net effect of the euro crisis would be clearly positive for Germany. The fiscal impact of the safe haven effect has so far not been discussed in Germany in a medium-term perspective. It is obvious that the warnings of the influential Ifo institute—which has emphasized in many publications that there are enormous risks involved if Germany guarantees and loans in the context of the euro rescue umbrellas—gives a very biased picture, which totally ignores the large positive fiscal gains from the safe haven effects. If a considerable part of the additional capital inflows into Germany come from countries outside the euro area one may expect a real appreciation of the euro, which would dampen the exports of all euro countries. In 2010-2011 there was no depreciation of the euro as one might have expected in a euro crisis, but the safe haven effect affecting Germany, France, the Netherlands, Luxembourg, and a few other euro area countries might explain the stable exchange rate vis-à-vis the U.S. dollar. In addition, the quantitative easing policy in the UK, the U.S., and Japan has brought an appreciation of the euro, as implied in the reduction of the market interest rate in all three countries and the parallel depreciation of the respective currencies.

Figure 2: Impact of Safe Haven Effects in Germany

Transatlantic Policy Issues

The dominant role of the U.S. dollar is likely to decline in the long run as the role of China’s currency is bound to increase.[16] A rising euro could also undermine the position of the dollar, but it is unclear that the euro area can achieve the status of a political union that combines joint political leadership in the monetary union with a competitive banking system and low inflation rates.

For the euro crisis countries, both the U.S. debt situation and the debt dynamics of the UK (and potentially also of Japan) are crucial side constraints. The downgrading of the U.S. sovereign debt by Standard & Poor’s in 2011 weakened the reputation of U.S. debt—although one may argue that the rating agency had no clear arguments why the U.S.’ rating should be reduced. On 5 August 2011, Standard & Poor’s reduced the long-term rating of the U.S. from AAA—the standard rating since 1941—to AA+. According to this revised rating, the U.S. is as weak as Belgium, which was quite dubious since Belgium’s gross debt-GDP ratio and its net debt-GDP ratio was higher than that of the U.S. (although a few months later Belgium’s rating was also reduced). Additionally, Belgium is characterized by an unstable government and a rising burden from the euro rescue funds. On its website, S&P lists the five elements it considers for the country’s rating, namely political and economic aspects as well as external, fiscal, and monetary aspects. The weighing scheme used by S&P is quite vague and it may be doubtful that S&P is using a scientific approach.

The U.S. Securities and Exchange Commission (USSEC) presented a report in 2008 on the quality of the rating processes of the leading rating agencies for the previous years and the findings—looking mainly at the rating of asset-backed securities—were quite sobering: weak quality standards and many cases of sloppy work suggested that the rating oligopoly is not delivering high quality signals that international capital markets, banks, hedge funds, and insurance companies as well as other companies urgently need. It is absolutely unclear whether the methodology of rating and the quality of the underlying workflow process have strongly improved.

It is high time to improve the overall process of the rating business.[17] One way to improve the quality of ratings is to involve more scientific knowledge. It probably would require €250 million over a three year starting period as a minimum investment to start a new rating company that would be based on a network of university researchers or new research units outside universities. Here the EU could give a decisive impulse for better transatlantic and global ratings. There could be a public tendering, open to various research institutions, that would cooperate under the umbrella of a newly created foundation. For every ten year period, there should be a new tendering process for scientific rating networks. Researchers from Europe, the U.S., and Asia could cooperate, thereby generating stronger competition and improving the quality of the rating process. The standard argument that more competition brings lower quality of rating is quite doubtful as the main short-term impact of a newcomer gaining market shares will be to encourage more firms to seek a rating. If it is assumed that new firms seeking a rating have less experience in the capital market and are also economically and financially somewhat weaker than the existing stock of firms already rated, it would be no surprise to find that a rising market share of the newcomers goes along with a reduced probability of faulty forecasted ratings

The rating issues are no excuse for leading OECD countries not to seriously cope with high debt-GDP ratios. As one may assume that debt-GDP ratios above 90 percent negatively affect economic growth,[18] there is every reason that the U.S., the UK, Japan, and the euro area should try to reduce their debt-GDP ratios in the medium term. The strong increase of the debt-GDP ratios by almost 25 percentage points between 2007 and 2012 in OECD countries has been a shock to the Western world and naturally will go along with a transitory rise of the tax-income ratio; this is the unavoidable consequence of the rising interest payment-GDP ratio faced by almost all OECD countries in 2011-2015. Cutting social security benefits is also likely to be a collateral damage of the debt-GDP shock, which largely reflects the impact and echo effects of the transatlantic banking crisis. Higher tax rates might reduce economic growth temporarily in OECD countries; reduced social security benefits could reinforce protectionism and resistance against economic globalization. The temporary reduction of output growth in OECD countries is bound to reinforce the relative rise of China’s economic weight in the world economy. It thus also indirectly reinforces the role of Asia in the world economy and in international economic organizations.

Leading EU countries, the U.S., Canada, Japan, and Russia have reduced their cooperation in the G7/G8 framework, undermining the West’s international leadership. The G20, with its big differences in per capita income, is by no means a substitute for the G7/G8. The G20 is slow in achieving consensus both because the group is rather big and because the large differences in per capita income imply large conflicts of interests and different political preferences. It might be useful to establish a special new compact group, namely the U.S., the UK, the euro area, and Japan, as a new cooperation group willing to fight high debt problems. Cooperation could help all four countries to avoid switching to strong parallel austerity policies. Moreover, it also might be useful to consider joint opportunities to reinforce economic growth, e.g., by joint innovation and investment initiatives in the field of information and communication technology, which is considered to be of key interest for productivity growth and economic growth. While many U.S. observers consider the euro area as a weak economic group in the aftermath of the 2010-2011 crisis, it should not be overlooked that the UK is much weaker in terms of innovation and industrial dynamics, and it also has a deficit-GDP ratio higher than the euro area and will have a higher debt-GDP ratio as of 2013. The big advantage that the UK has, however, is—at least for the moment—that its central bank is willing to act as a lender of last resort while the ECB is not in such a position, not least because there are no supranational euro bonds in the monetary union. As soon as the euro area would become a political union the structural weakness of the UK would become obvious for all major actors in the global capital market. Once the euro area has been stabilized and a euro political union achieved, the euro could easily play its potentially strong role as a global currency and a reserve currency. Even if it would achieve only half the global market share of the U.S. dollar, it would realize enormous economic benefits from its reserve currency position. Assuming that the interest paid on euro bonds is 2 percent lower than the yield in the euro area—and assuming that there would be a stock of global currency reserves of €2 trillion denominated in euros—the euro area countries could enjoy a current account deficit of 0.44 percent of GDP as a free lunch (which is less than the benefit U.S. citizens enjoy).

Right-wing political parties, many of which suggest that euro countries would have an advantage in giving up membership in monetary union, typically have no idea of the benefits just mentioned or are they aware that the pure effect from the elimination of transaction costs within the euro area amounts to 1 percent of GDP.

Toward a Political Union and New Policy Initiatives

The euro area will be inherently unstable in the long run if it continues with its present institutional setup. It would be useful to switch from an incipient fiscal union—as designed in the Fiscal Compact of December 2011—to a full euro political union that would consist of five key elements:

- A euro area parliament (technically this could be a subgroup of the European Parliament).

- A euro government, which would be elected from the relevant parliament.

- A broader supranational government budget should represent about 4-5 percent of the GDP of the euro area—up from the 1.1 percent spent at the EU level in 2011. In particular, infrastructure expenditures and military expenditures should be shifted from the national level to the supranational level, possibly along with elements of innovation policy and higher education policy. If the economic role of the supranational level increases, interest in supranational policy in the euro area/EU would certainly also increase and could be the basis for enhancing the efficiency of the governmental process at the supranational level. Thus the so-called principle of subsidiarity is not necessarily in opposition to a bigger role of the European supranational economic policy.

- A euro parliament would be a natural political body to decide about the placement of supranational euro bonds in capital markets.

- A relatively strict supranational supervision of financial markets would be a useful element for achieving efficiency and stability in the euro area and the EU.

It seems advisable for Germany and France and select other euro member countries—possibly including the Netherlands, Belgium, Luxembourg, and Italy—to develop a joint initiative for the creation of a Euro Political Union. A broad public discussion in Europe is needed about such a major shift in the institutional setup of EU countries. Are there any major incentives to defend the economic and monetary union? What are the incentives of switching to a political union? The costs of political union in the short run lie in the loss of political power at the national level—the layer at which most power is currently concentrated. The incentive for politicians at the national level to give up power naturally is small unless the creation of a stronger supranational policy level would help to stabilize the national political-economic system and unless a stronger supranational layer can offer new and better career opportunities. As regards the latter, it is obvious that the very low budget of the EU—with expenditures amounting to 1.1 percent of GDP—is quite unattractive compared to 20 percent government expenditures plus another 20 percent for social security concentrated at the national level. Comparing the U.S. and the euro area (or taking a closer look at basic economic criteria for the vertical allocation of policy tasks in a federal system), it is clear which budget items should be at the supranational level. Moreover, it also is obvious that the unemployment insurance system should remain in the hands of the national policymakers. Part of the pension system could be shifted toward the supranational level, but only the small portion dedicated to pensions for civil servants working for the future “euroland government.” Part of the health budget, namely many items related to health R&D, could also shift to the supranational level since medical progress achieved in the euro area would potentially benefit each citizen in the monetary and political union. Infrastructure expenditure on big international projects and part of military expenditures are also obvious elements for the supranational policy level.

The Size of Economic Gain from a Monetary Union and a Political Union

There is a broad issue whether a monetary union makes economic sense in the EU. Recall that the creation of the euro area eliminated transaction costs, which amounted to 1 percent of GDP (this figure was a consensus estimate prior to the creation of the monetary union). This, however, is largely a one-off effect; avoiding transaction costs of a multi-currency system plays a role in the future as well, but only in the context of economic growth. Hence, if one assumes a nominal growth rate of 5 percent for the euro area, the annual extra benefit will be 0.05 percent per year.

Moreover, the euro—in the context of a stable monetary union with an efficient international banking system and a low inflation rate—functions as an international reserve currency, which should generate considerable benefits for the 330 million people of the euro area. If one assumes that the euro-denominated foreign reserves equal €2 trillion, which is equivalent to a share of 25 percent of global reserves or roughly half of the U.S. share in global reserves, the euro area can run a “free” current account deficit of 0.44 percent of the euro area GDP provided that the differential between the yield on investment in global markets and the interest rate paid on euro-denominated bonds is two percentage points (the share of 0.44% is based on a euro area GDP of €9 trillion in 2011).

Regarding the gap between the international yield on investment and the interest rate paid on euro government bonds, Barry Eichengreen pointed out that the yield gap is 2-3 percentage points in the case of the U.S.[19] The assumption made here for the euro is that the international yield gap is 2 percentage points. If the euro could increase its share in global reserves to 37.5 percent, the free net import-GDP ratio would increase from 0.44 percent to 0.66 percent. It is obvious that the status of a reserve currency can only be maintained if the euro area is a large trading partner and in combination has low long-run inflation and a stable, efficient banking system. The sovereign debt crisis is undermining both the prospects for a stable banking system and a low long-run inflation rate.

It is plausible to assume that a political union in which most government bonds would be supranational bonds in the long run (say 60 percent of all government bonds) will have a nominal and real interest rate 1 percent below that of the euro area, which has only national euro bonds. It also has been assumed that in a future political union the ECB would be willing to play the role of a lender of last resort. This does not mean an inflationary bias but sends a strategic signal to market participants that the central bank feels a broad responsibility to make sure that supranational euro bondholders will obtain interest payments under any reasonable circumstances. In such a setting the cost of capital for firms would be lower by 0.5 percentage points compared to the first decade of the euro. The implication is that the investment-GDP ratio would be higher and that the GDP steady state growth rate would increase by about 0.25 percent. Finally, the use of the euro in the euro single market brings other dynamic benefits, including an increase of the rate of technological progress by 0.1 percent. The following table shows permanent benefits of the creation of the euro area (Table 2):

Table 2: Permanent Benefit from Monetary Union in Combination with Political Union: Increase of the Growth Rate of GDP (including “free” imports of goods and services=reserve currency effect)

| 1) Reserve currency advantage effect | 0.44% – 0.66% |

| 2) Elimination of transaction costs | 0.05% |

| 3) Creation of supranational euro bonds | 0.1425% |

| 4) Enhanced competition/higher rate of technological progress | 0.01% |

| 5) TOTAL EFFECT | 0.7%-1% |

A 0.7 percent increase of the permanent growth rate is very high if we consider that the standard assumption of the EU’s real GDP long-run growth rate normally is in the range of 1.5-2 percent. However, the true growth bonus is only half the total effect indicated in the table above—almost half a percentage point—is from the free import of goods and services enjoyed as a natural privilege of a reserve currency. For a family of four the annual benefit is about €1,000 per year. This benefit could be reaped if deficit rules in the euro area could not be imposed since such a state of the monetary union implies economic and political instability. Creation of a political union therefore could help to reinforce global confidence in the euro and thus would reinforce the reserve currency advantage effect. The considerable euro benefits pointed out here—and also emphasized in my presentation to the Finance Committee in the Deutsche Bundestag on 9 May 2012—are much in contrast to the unfounded conjecture of Thilo Sarrazin who claims in a new book (Europa braucht den Euro nicht) that the benefit of the euro for the currency union is zero.

The considerable benefit from the creation of supranational bonds can only be reaped through a political union; any form of synthetic euro bonds guaranteed by autonomous national governments are a very imperfect substitute for supranational euro bonds. Some power to tax will have to be given to the supranational policy level if supranational bonds are to enjoy the top confidence needed to reap the benefits of very low interest rates. In a political union in which the supranational policy level would be responsible for counter-cyclical fiscal policy and stabilization policy, respectively, there is no need for national policymakers to run permanent deficits. From this perspective the euro area should become more American in the long run—at least if the euro and the ECB are to survive in the future.

Conclusion

The project of a monetary union in Europe makes sense in economic terms provided that the euro countries can implement a political union. It is unclear whether Germany and France could launch a joint initiative for such a project. Under Chancellor Merkel, the German government seems to lack a clear idea of the long-run goals of European integration. Measures taken are inadequate for avoiding the type of political fraud faced in Greece in 2009 when government totally misreported the deficit to the European Commission. Effective implementation of deficit rules requires some technical measures, including implementation of uniform software in all treasuries of euro area countries and in the Commission itself; and the Commission must have the right to look real time into all national budget figures.

The debt problems in the U.S., euro area, and the UK are rather similar except that both the U.S. and the UK have a central bank that plays the role of a lender of last resort, willing to defend the national currency. Holders of U.S. bonds denominated in U.S. dollars can be confident they will get interest payments and principal in U.S. dollars; however, it is an open question what the value of this dollar in terms of goods will be. The U.S. inflation rate is under the control of the U.S. Federal Reserve, which is part of the broader U.S. political system.

Regarding the euro crisis, Europe and Germany face a decisive juncture. The euro crisis naturally calls for political leadership. Such leadership to some extent is a joint exercise of many euro countries, but it clearly cannot work in the long run as such a complex system of shared leadership of seventeen euro countries. The euro area cannot be stabilized permanently without a shift toward a political euro union. This would mean shifting expenditures from the national level to the supranational level so that anti-cyclical fiscal policy can exclusively be implemented in Brussels in the future. The structural deficit ratio at the national level should be zero—similar to rules in the U.S. for the states. Brussels should have the right to issue supranational euro bonds and also the right to raise taxes. The ratio of government expenditures on interest rates—relative to GDP—would fall by about 1 point and thus the income tax rate and the corporate tax rate could be reduced, resulting in higher investment and economic growth. Thus creation of a political union effectively amounts to a true growth policy.

There is no need to kick out Greece from the euro area (see also the U.S. at it dealt with states facing bankruptcy in the 1830s and 1840s) and if Athens itself would choose this option this would stand for a self-inflicted economic disaster as output is likely to contract by about another 15 percent in 2012-2013 followed by unemployment rates in excess of 30 percent, a wave a mass emigration, and a wave of crime and rising corruption. If Greece is leaving monetary union this also means bankruptcy as the associated very strong devaluation of the new drachma would raise foreign debt, expressed in drachma, enormously and most banks would be bankrupt within days and the economy would face a disaster from which rebounding will be difficult. From the euro area countries’ perspective the only advantage is that the UK and all other EU partner countries now would have to share the burden of massive transfers and financial support to stabilize the EU member country Greece, which is to some extent entitled to support. A potential bankruptcy of Greece would have a negative impact on the deficits in EU countries; there would be rising debt-GDP ratios in many countries also in the context of a serious recession in the euro area.

The fact that the debt-GDP ratios of the euro area, the UK, Japan, and the U.S. are rather high implies that there is a joint challenge of coping with the debt problems. If all four countries (including “euroland”) should embark on parallel austerity policies, this would trigger a global recession and the associated recession in the OECD area could indeed bring about a rise of the debt-GDP ratio in many countries. Such inefficient policy strategies are not desirable. Therefore, more cooperation is needed and the G20 forum is not really useful, as it stands for a very heterogeneous and rather large group of countries with different policy priorities.

In Brussels there is very weak leadership—and limited understanding of the crisis; few politicians seem to be interested in establishing responsibilities for what has happened, which is a prerequisite for learning from the crisis. Without clearly spelling out the major policy pitfalls in Athens and Dublin the euro area can neither fix the true problems nor restore international confidence. The euro area faces serious problems ahead and one may anticipate a major crisis in the EU, which suffers from a strange combination of lack of realism and ability to launch EU reforms needed for overcoming a crisis which could result in an OECD-wide recession and in renewed political conflicts within NATO. With the U.S. bound to trim its budget deficit after 2011, the transatlantic challenges are getting even more complex.

Prof. Dr. Paul J.J. Welfens is Jean Monnet Professor for European Economic Integration; chair for Macroeconomics; president of the European Institute for International Economic Relations (EIIW) at the University of Wuppertal; Alfred Grosser Professorship 2007/08, Sciences Po, Paris; Research Fellow, IZA, Bonn; and a Non-Resident Senior Fellow at AGI/Johns Hopkins University, Washington DC.

[1] European Commission, “Economic Adjustment Programme for Ireland, European Economy,” Occasional Papers No. 93 (Brussels, March 2012), 37.

[2] Ibid., 36.

[3] Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung, Jahresgutachten 2011/2012 (Berlin and Wiesbaden, 2011).

[4] International Monetary Fund, “Greece: Second Review Under the Stand-By Arrangement – Staff Report”; “Press Release on the Executive Board Discussion”; and “Statement by the Executive Director for Greece, Country Report No. 10/372” (Washington, DC: International Monetary Fund, 2010).

[5] Ibid.

[6] Deutsche Bundesbank, “Yields on Bunds under safe haven effects,” Monthly Report (Monatsbericht), October 2010, 30–31.

[7] Hans Werner Sinn, the influential head of the state-run Ifo Institute in Munich, publicly pointed out the risks Germany might face. He has been eager to put new and higher price tags on the government rescue operations and the ECB’s acquisition of bonds of crisis countries in 2010-2011. On 11 September 2011, he argued in the Frankfurter Allgemeine Sonntagszeitung that the German government should boycott the European Central Bank; obviously, Sinn disliked the fact that the ECB has bought government bonds of Greece, Ireland, Portugal, and Italy. I protested against Sinn’s boycott in a piece on 27 September in the Handelsblatt.

[8] European Commission, Alert Mechanism Report, Com(2012) 68 final (Brussels, 2012), 19.

[9] Paul J.J. Welfens, Jens K. Perret, Deniz Erdem, “Global economic sustainability indicator: Analysis and policy options for the Copenhagen process,” International Economics and Economic Policy 7 (2010), 153-185.

[10] Paul J.J. Welfens, Transatlantische Bankenkrise (Stuttgart: Lucius, 2009)

[11] European Commission, “Economic Adjustment Programme for Greece. Fifth Review – October 2011, European Economy,” Occasional Paper No. 87 (Brussels, 2011); European Commission “Economic Adjustment Programme for Ireland, European Economy,” Occasional Papers No. 93 (Brussels, March 2012).

[12] European Commission, “The Economic Adjustment Programme for Portugal. Second Review – Autumn 2011, European Economy,” Occasional Paper No. 89 (Brussels, 2011).

[13] Projektgruppe Gemeinschaftsdiagnose, Deutsche konjunktur im aufwand – Europäische Schuldenkrise schwelt weiter (Berlin, 2012).

[14] European Commission, “The Second Economic Adjustment Programme for Greece, March 2012, European Economy,” Occasional Papers No. 94 (Brussels, 2012).

[15] Deutsche Bundesbank, “Yields on Bunds under safe haven effects,” Monthly Report (Monatsbericht), October 2010, 30–31.

[16] Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System (Oxford: Oxford University Press, 2011).

[17] I have presented several proposals for improvement: Paul J.J. Welfens, “Transatlantic banking crisis: analysis, rating, policy issues,” International Economics and Economic Policy, Vol. 7 (2010), 3-48; Paul J.J. Welfens, “The Transatlantic Banking Crisis: Lessons, Reforms and G20 Issues,” in Financial Market Integration and Growth – Structural Change and Economic Dynamics in the European Union, ed, Paul J.J. Welfens and Cillian Ryan (Heidelberg: Springer, 2011), 27-48; Paul J.J. Welfens, ed., Zukunftsfähige Wirtschaftspolitik für Deutschland und Europa (Heidelberg: Springer, 2011); ; Paul J.J. Welfens, Die Zukunft des Euro. Die europäische Staatsschuldenkrise und ihre Überwindung (Berlin: Nicolai, 2012).

[18] Carmen M. Reinhart and Kenneth Rogoff, This Time it is Different: A Panoramic View of Eight Centuries of Financial Crises (Princeton, NJ: Princeton University Press, 2009).

[19] Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System (Oxford: Oxford University Press, 2011).