A Missed Chance: The Grand Coalition and Public Investment in Germany

Sebastian Dullien

Macroeconomic Policy Institute (IMK) and HTW Berlin – University of Applied Sciences

Sebastian Dullien is Research Director at the Macroeconomic Policy Institute (IMK) of the Hans-Böckler-Foundation in Düsseldorf, professor for International Economics at HTW Berlin – University of Applied Sciences and Non-Resident Senior Fellow at AGI. His research focuses on European integration, international macroeconomics, and financial market regulation.

He has worked as a consultant and expert for the different political foundations, different sub-organizations of the United Nations, and has testified in front of different committees of the German Bundestag and the European Parliament.

From 2000 to 2007, he has worked as a journalist for Financial Times Deutschland, the German language edition of the FT. He first worked as a leader writer and then moved to the Economics desk. From 2002 to 2007, he has been responsible for the paper’s coverage of the global, European and German business cycle as well as developments in German academic economics.

Today, he writes a monthly column in the German magazine “Capital”, regular contributions to Spiegel Online, and irregular op-eds for a number of other German media.

His book “Decent Capitalism” (joint with Hansjörg Herr and Christian Kellermann), which provides a blueprint for a better regulated are more stable capitalism after the crisis, has been published in 2011 by Pluto Press. An earlier German version (“Der gute Kapitalismus”) has been widely discussed in Germany.

The rest of Europe has lately been looking with envy at Germany. Over the past decade or so, Germany has morphed from the sick man of Europe to Europe’s economic powerhouse in the public perception. German machinery and luxury cars are exported all over the world, and Germany now has the world’s largest current account surplus in dollar terms. Moreover, the unemployment rate now is much lower than in most other OECD countries and has even dipped below that in former model countries such as the Netherlands.

Yet, all is not well. While it is relatively well known outside of Germany that the country faces a demographic challenge as its native working age population will decline sharply over the coming decades, it is less well known that German infrastructure is deteriorating fast. And, what might even be worse: Even though this problem is becoming increasingly evident, the coalition agreement between Social Democrats and Christian Democrats, which will shape policies over the coming four years, only pays lip service to the problem. Hence, the decline might well continue for at least another half a decade.

Americans still might have an image of spotless German infrastructure and broad Autobahns on which one can drive at more than 100 miles per hour. Unfortunately, reality looks different. Roads are increasingly full of potholes. More and more bridges on the Autobahns are closed for heavy-load trucks. And cars and trucks clogging the main traffic arteries make any attempt at driving really fast pointless.

Other means of transportation are not in much better shape: Waterways and their locks often date back to the time of the Kaiser (about 100 years ago). While they still work, experts say they can break down anytime. In addition, the locks are often too small for modern boats, making transportation on the waterways more expensive than it actually needs to be.

Energy infrastructure is another problem. While the German government has decided to phase out nuclear power and the use of renewable energies has grown considerably over the past years thanks to very generous subsidies, the grid has not kept pace. As renewable energy production fluctuates more over time than power production in coal or nuclear plants, much more grid capacity is needed. However, energy companies have been reluctant to make the necessary investments.

Together, this is more than a mere nuisance. Bridges closed to heavy transport often means detours of several hundred kilometers. Bringing a heavy piece of equipment from a manufacturer to its customer (or to the border in the case of exports) might take three nights instead of one. In addition to tripling the transportation costs, this makes German businesses less flexible and delivery of its expensive high-end products less swift.

How vulnerable the German infrastructure has become was once again demonstrated to millions of Germans this summer: Extensive flooding in May led to the most important main artery in train traffic from Berlin to the west of the country being closed until November, more than doubling the travel time from the capital to Volkswagen’s headquarters in Wolfsburg. Taking a return trip on a working day, as many had become accustomed to do, suddenly was impossible. And as working on a crowded train is usually not very productive, this time lost was lost production and lost productivity for the German economy.

All this might not sound very serious, but potholes on the streets have relevant economic costs: When highly qualified engineers spend their time in traffic jams, they are not doing paid work at a client’s site. This is even more serious when companies are complaining that they cannot find enough qualified personal to fulfill all the required work.

This is all the more important as German companies have increasingly integrated into pan-European production networks and they count on the just-in-time availability of parts and components. These are often sourced from Central and Eastern Europe and then brought back to Germany, where they are further processed and re-exported. The lower labor costs for more simple tasks in the East have helped to boost German competitiveness.

Unreliable power supply can also be a serious cost factor: If production companies cannot count on the stability of the public energy grid, they have to invest in their own backup equipment and their own power production.

All this means that the shaky infrastructure in Germany makes domestic production increasingly difficult and expensive, and the economic data have begun to reflect this. Productivity measured in output per working hour is now roughly at the level of 2007; such stagnation has not been observed here since the Second World War.

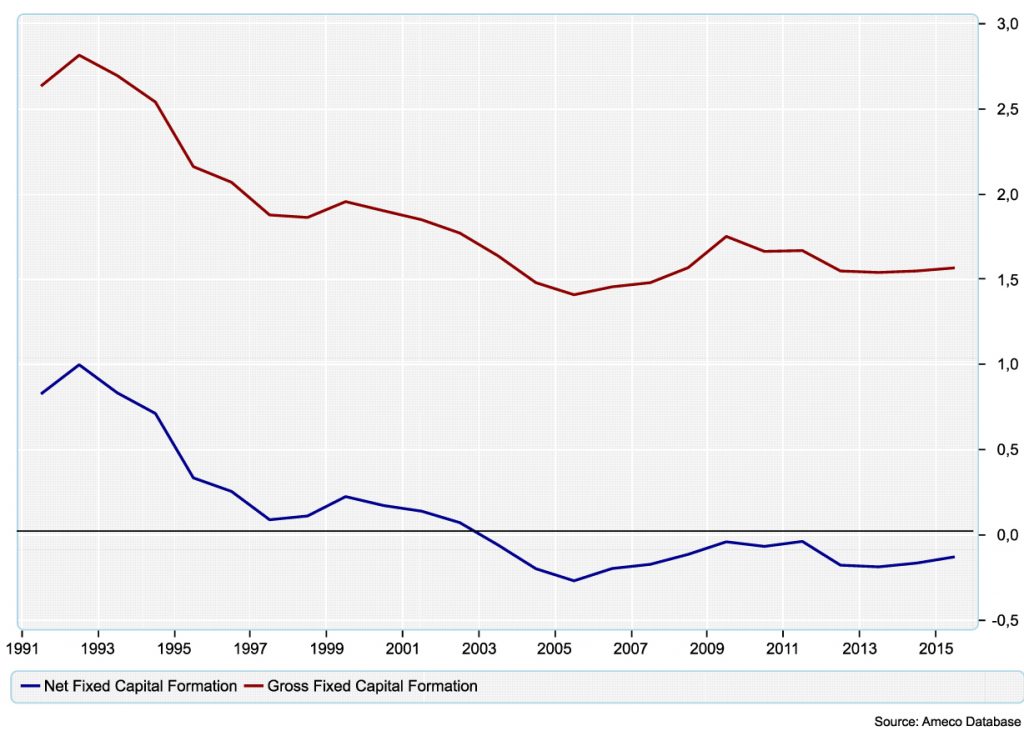

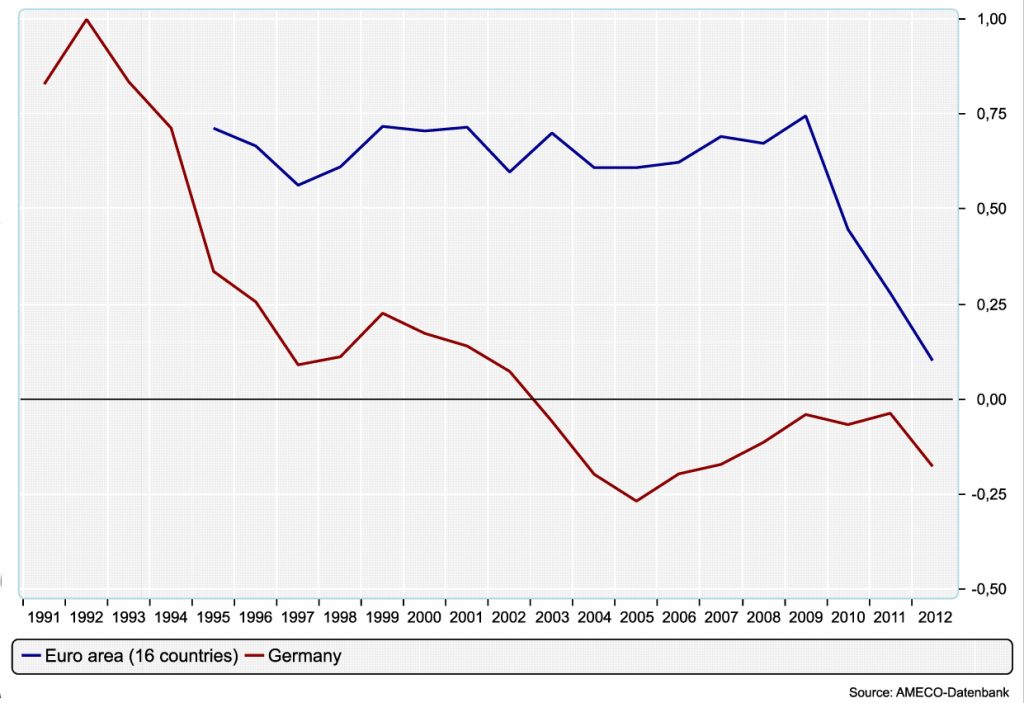

Behind the problems in infrastructure is a permanent starvation of public investment of funds for more than the decade. After a binge in infrastructure spending after reunification in the early 1990s, politicians cut back on public infrastructure expenditure soon afterward. Having reached almost 3 percent of GDP in 1992, gross public investment was almost halved over the next decade, reaching a historic low of 1.4 percent in 2006.

In net terms (that is, after depreciation for wear and tear) and in comparison to the rest of the euro area, this development was even more dramatic. While until the mid-1990s, German net public investment was still higher than in the rest of the euro zone, it dipped below that of the partner countries in the second half of the decade. In 2003, net public investment even turned negative and has remained so since. Or in other words: For a decade now, Germans have lived off the substance of their infrastructure and are seeing it slowly decay.

One of the reasons for this secular decline can be seen in the advent of European Monetary Union (EMU). As the Maastricht Treaty had prescribed a maximum public deficit-to-GDP ratio of 3 percent as a convergence criteria to monetary union and Germany found itself with a significant budget deficit after the national reunification, the second half of the 1990s were characterized by austerity packages in Germany. The downward trend was only briefly interrupted after a center-left government under Social Democrat Gerhard Schröder came into power in 1998 and part of the growing government revenue from the IT boom of the late 1990s was channeled into more public spending.

This new appetite for public investment quickly came to an end: When the recession hit in late 2000 and continued into 2001, Germany soon came into conflict with the European Stability and Growth Pact, which threatened countries recording a budget deficit of more than 3 percent of GDP with fines. As Germany struggled with the fact that it may no longer be the model student with spotless public balances, the government passed several austerity packages.

The domestic political economy logic resulted in cuts mainly affecting spending on education and infrastructure. Infrastructure in particular was in a relatively good state after the investment boom of reunification, so cuts in investment were not readily noted by the general population. Cuts in pension spending or other social expenditures would have created much more uproar, and tax increases were not on the table as the government had just cut income and corporate tax rates. Consequently, politicians cut where it hurt least in the short run.

However, more than ten years later, a decade of underinvestment can no longer be hidden. For a number of years, both business federations and economic experts have called for a change in Germany’s investment policies. The German Institute for Economic Research in Berlin (DIW) called for huge increases of investment spending in a widely noticed report earlier this year.

Some observers had hoped that a new government would bring a turn-around. The Social Democrats had called for more investment spending in their election manifesto, financed by higher income taxes for top earners. They had also demanded to increase spending for education and research and development.

Unfortunately, nothing of this has materialized. A significant increase in spending on infrastructure and education did not made it on the list of priorities the Social Democrat leadership took into the coalition negotiations and, consequently, it did not make it into the coalition agreement.

The only positive thing one can say is that the agreement now reflects that the ruling politicians are well aware of the growing problem with Germany’s economic foundation. Consequently, they tried to talk up their efforts to reverse the decay in infrastructure. In their coalition agreement, Social Democrats and Christian Democrats promised to increase investment both in infrastructure as well as education, child care, and research and development by about €23 billion. Taken at face value, this is quite impressive—about 1 percent of Germany’s annual GDP.

Unfortunately, upon closer examination, one sees that there is much less behind the promises than the headline figure would suggest. First, the coalition partners have added up additional spending over the whole period of the next government. A total of €23 billion over the coming four years thus shrinks to less than €6 billion in additional annual spending (or about 0.2 percent of GDP). Interestingly, they only did this kind of reporting for investment. When it came to spending for more generous pensions, they reported the costs on an annual term, not for the whole period of their expected government.

Second, the relevant number in economic terms is the ratio of public investment-to-GDP. The numbers provided by the coalition are in nominal terms, and they are given in comparison to a baseline of stable nominal spending. Some of this extra spending is necessary to keep up with inflation and the growth of the economy. With public investment at €42 billion annually, an increase of annual spending by €5.25 billion until 2017 is necessary to keep the public investment-to-GDP ratio stable (assuming 2 percent inflation and 1 percent economic growth). So, the proposed increase in investment spending will not sufficiently bring up the investment-to-GDP ratio and will thus do little to improve German infrastructure.

So, why is the new German government so reluctant to tackle a well-known and potentially serious problem? The answer is that Christian Democrats and Social Democrats have been trapped by their election promises and their joint economic ideology.

The two large restricting factors are the German constitution’s prohibition of new public debt and the Christian Democrats promise not to increase taxes. When Christian Democrats and Social Democrats ruled together the last time, from 2005 to 2009, they decided to put a so-called debt brake into the constitution, limiting new public borrowing by the central government to 0.35 percent of GDP, which they later extended to the rest of the euro zone through the fiscal compact. So, today, even if a public infrastructure project yields an economic return of 10 percent annually, while the German government could finance it with bonds for only 1.8 percent (as it is currently the case), the investment will not be made thanks to the prohibition to borrow—even for investment.

At the same time, Christian Democrats entered the coalition talks with the demand that “there must be no tax increase” and while the coalition agreement does not explicitly exclude tax increases for the coming four years, it implicitly excluded a tax-and-invest strategy as it only promises minor changes in public investment.

Ironically, both Social Democrats and Christian Democrats claim that they have designed their policies to “defend the interest of future generations.” Very few in the two large parties seem to notice that, if they follow through with their promises, they will actually burden future generations with their short-sighted policies. After all, a few percentage points of less government debt cannot buy the benefits of a world-leading manufacturing sector—which might lose its edge if Germany runs out of proper roads.

Sebastian Dullien is professor for international economics at HTW Berlin – University of Applied Sciences and Senior Policy Fellow at the European Council on Foreign Relations.