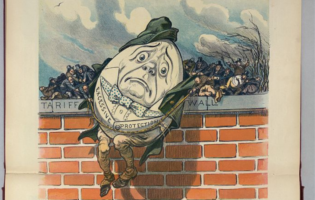

Mouser Williams via Flickr

A Limping Coalition of the Willing

Charlotte Unger

Research Institute for Sustainability Helmholtz Centre Potsdam (RIFS)

Charlotte Unger is an AGI/DAAD Research Fellow from May to July 2023.

Dr. Unger is a Senior Research Associate at the Research Institute for Sustainability Helmholtz Centre Potsdam (RIFS). She holds a PhD in political sciences from the Technical University of Munich (TUM). Her work focuses on global climate governance, innovative climate alliances, carbon markets, and climate policy in Germany, the EU, and the United States. She also managed the scientific groundwork for the Berlin Climate Citizens Assembly and represents the RIFS in national and international climate fora, e.g., the United Nations Framework Convention on Climate Change (UNFCCC). Charlotte draws from many years of experience in the field of environmental policy, gained in civil society, governmental, and scientific institutions.

Her current research is motivated by the state of international climate politics: As countries’ national pledges are not ambitious enough to achieve the Paris Agreement’s climate goals, an increasing number of additional global climate initiatives, pledges, and clubs have emerged. These innovative initiatives are often transnational and usually focus on a specific sector (e.g., the Global Methane Pledge) or group of actors. Also, initiatives which originally were aimed at other issue areas, such as trade, economics, and security, are increasingly active in climate policy (e.g., G7). Dr. Unger researches these initiatives from a comparative, case studies perspective to discover their contributions to the global climate regime. Further, she is interested in what drives countries to launch and be active in these alliances, specifically the United States, EU, and Germany, but also countries from the Global South.

During her stay at the American-German Institute, she will look at innovative climate initiatives in which the United States, Germany, and the EU have a leading role, such as the Global Methane Pledge and an emerging alliance on steel. For the latter, several initiatives were announced from different sides: The United States announced a “Global Arrangement on Steel” at the end of 2022 together with the EU. Germany pushed the launch of a climate club under the G7, which will also focus on the steel sector. Dr. Unger will particularly look at the differences between the United States and Germany (and the EU); e.g., why, the Global Methane Pledge seems to have gained much importance in the United States, whereas in Germany the topic has hardly gotten any political attention. For the steel initiative, she asks how governments will make sure to create an effective alliance that coordinates rather than competes with parallel similar proposals. An overall question to be tackled is: What effect do these initiatives have on transatlantic relations—i.e., are they also aimed at building a block against supposedly climate policy laggards or otherwise market competitors like China?

Why is Transatlantic Cooperation on Clean Steel Lagging Behind?

The 2020s have arrived as a decade of multiple crises. Beyond their devastating impact, however, these crises have also changed our political debates. For instance, all around the world, we have started to think of “transformation”: To cope with the present challenges, we need to go beyond making small adjustments, efficiency improvements, and grabbing the low-hanging fruits and fundamentally alter our current way of life. The discussion has reached the heart of our economies and, first and foremost, those sectors that ten years ago we thought almost impossible to decarbonize such as the steel industry.

The steel sector is a fundamental building block of countries’ industrial development. In our cars, fridges, buildings, infrastructure, or military equipment, steel is an integral part of our day-to-day lives. In addition to its economic value, this makes steel a politically sensitive and culturally treasured sector. It also creates strong interdependencies with other sectors and diverse supply chains.

International trade and competition are an important dimension of the steel sector, as approximately 25 percent of global steel production is subject to export. The top five crude steel producers are China (ca. 54 percent), India (ca. 6.6 percent), Japan (ca. 4.7 percent), the United States (ca. 4.3 percent), and Russia (3.8 percent). Germany is the largest steel producer in the EU. International competition leads to concerns about investment and carbon leakage. Governments fear that their steel production could relocate to countries with more favorable conditions (e.g., for investments, environmental regulations, subsidies). These characteristics, in addition to the technical challenges that come with decarbonization, make the steel sector “hard to abate” (in terms of emissions). Overall, the steel industry is not on track for a net zero emissions scenario by 2050. Total emissions have risen due to a higher demand for steel, and emissions intensity has stagnated. The reason for this is arguably a lack of progress in fundamental, transformative changes and deep decarbonization.

The good news is, however, that decarbonization is not impossible. Technological solutions, such as increased metal scrap use, electricity based on renewable energies, green hydrogen, and Carbon Capture and Storage (CCS) can bring the steel sector toward a net zero production and are available or under development. Yet not all technologies are at the stage of market readiness or large-scale implementation. Their establishment requires large state and private investments and support structures.

The struggle to decarbonize the heavy industry sector(s) must be seen against the background of an international climate policy landscape in which countries move at very different paces and which has resulted in a patchwork of approaches. Also, we see an increasing overlap with other policy sectors, first and foremost international trade. Yet, many of the international systems, structures, and procedures, e.g., the World Trade Organization (WTO) or the United Nations Framework Convention on Climate Change (UNFCCC), are not fit to govern the dynamically changing environment. The United States, the EU, and Germany have responded to this situation with the launch and proposal of minilateral initiatives or clubs. They propose to start a policy deal with few or even only two countries or regions and later offer it as an international solution where others can join if they comply with certain conditions.[1]

An example of such a “club” is the potential Global Arrangement on Sustainable Steel and Aluminum (GASSA). This deal is especially interesting because it was originally not motivated by climate concerns but was born out of a trade conflict between the United States and the EU. In 2018, then-U.S. President Donald Trump imposed tariffs on U.S. imports of steel and aluminum (respectively 25 percent and 10 percent), arguing that metal imports threatened national security, based on Section 232 of the Trade Expansion Act of 1962. This led to a conflict with the EU, which, when no bilateral exemption was negotiated, responded with retaliatory measures in the form of EU tariffs on U.S. exports and a trade dispute under the WTO. Under the following U.S. administration of Joe Biden, the United States and the EU ended the dispute and agreed on a quota for European imports that would not be penalized. However, the agreement foresees only a temporary hold of the tariffs. By October 2023, both parties intend to come up with a permanent solution in the form of GASSA.

The struggle to decarbonize the heavy industry sector(s) must be seen against the background of an international climate policy landscape in which countries move at very different paces and which has resulted in a patchwork of approaches.

GASSA will address both the decarbonization of the steel and aluminum industries and their production overcapacity in the global market. This includes negotiating carbon intensity standards, supporting the production of green steel and aluminum, and creating a green steel and aluminum market. Partners would also refrain from “non-market practices” and examine options to go against such practices from other countries. This is a clause directed at China’s impact on the steel market.

GASSA promises an opportunity to create a safe space for trading clean steel and protecting green investments. However, at the time of writing, only months before the deadline, negotiations are gridlocked. Can we still hope to see an agreement in October 2023, and what are the push and pull factors that influence these negotiations? Very broadly, six main questions can be discussed in this regard.

Six factors that push and pull negotiations on GASSA

First, what shall be the nature of GASSA? Legally we can distinguish between international treaties and more informal arrangements that are followed by domestic regulations in each region. While a treaty is a strong and binding form of cooperation, its decision-making process is very long, and it would require the consent of the U.S. Congress and EU bodies and member states. Thus, a looser regulatory solution seems likely. More pertinent is the question of what measures, instruments, and definitions will be in the arrangement. A whole range of possibilities exists here, from a definition of what clean steel is (and is not) to a common emissions standard for the carbon intensity of steel and aluminum. The deal could also contain concrete measures that complement the standards: tariffs, a border tax, public procurement, a ban on “dirty” steel, or project funding.

The United States and the EU have proposed two opposing design approaches for GASSA. Essentially, the U.S. model foresees a standard independent of production process based on a country’s average carbon intensity. Non-members with more emission-intense steel production would have to pay a tariff when importing to GASSA members. The EU, however, would like to see the United States implement a carbon border tax and/or connect GASSA to the EU Carbon Border Adjustment Mechanism (CBAM). It also favors separate, technology-specific (e.g., scrap-based vs. primary steel) accounting approaches. Both proposals have political and technological caveats. Technical harmonization between both approaches is complex and would take significant time.

Second, what economic benefits do negotiation partners expect from GASSA? For the EU, the permanent cancellation of the Section 232 tariffs would be an important step. But also on the U.S. side, experts calculated that the tariffs had a negative effect on the economy, because they raised prices for domestic manufacturers and the downstream industry. Beyond direct potential benefits, the creation of a free trade zone could bring a competitive advantage for low-carbon steel, supporting the capacity for clean steel, while at the same time filtering the “dirty” overcapacity, and, in theory, making “clean” steel cheaper and “dirty” steel more expensive. It might give the push for the creation of a clean steel market among GASSA members and at some point help to prevent carbon or investment leakage. However, historic experiences with steel trade regulations have shown that their effects are more complex. Metal price increases might not be prevented, as it would take some time until, e.g., imports of certain types of steel can be replaced by GASSA members’ production. Also, if excluded, China could employ expensive retaliation measures.

Third, with which domestic policies must GASSA be reconciled? The EU has named its new flagship climate policy, the Carbon Border Adjustment Mechanism, as its main concern in the GASSA negotiations. The EU CBAM also targets the steel imports to the EU, levying a fee according to the product’s embedded carbon. Starting in October 2023, U.S. steel companies fall under the EU CBAM pilot phase. It is yet unclear what a steel producer with a U.S.-average carbon intensity will have to pay in 2028, when payment obligations start. For now, the U.S. steel industry has not shown much concern, possibly because U.S. steel production is already less carbon-intensive than that of the EU. Also, only a rather small segment of U.S. exports would fall under the regulation. Nevertheless, GASSA negotiations might be lagging behind because much of the responsible policymakers’ capacity is taken up with getting the EU CBAM running by October 2023. EU policymakers would have to make certain that GASSA is technically compatible with the EU CBAM and not, for example, jeopardize the carbon price established there at the same time. Thus, from a policymaking perspective, it might simply be easier to get the first in place and running before agreeing to a new scheme.

Questions remain about how GASSA’s measures would be implemented and enforced to create a substantial value for the environment, but also about how a bilateral deal could then be turned into the intended global solution.

Fourth, which elements of the domestic policy cycle influence the negotiations on GASSA? The list of domestic policies and politics that influence the negotiations on GASSA is potentially very long, but two examples can be highlighted here. In the United States, the public debate has started to be dominated by the presidential elections that will be held in November 2024. Not only can the outcome of these elections influence the future of GASSA, but the electoral campaign also affects the “appetite” to make decisions. Both the administration and the Republican opposition likely will avoid domestically sensitive topics, such as increasing costs, inflation, or provisions that raise fears of loss and disadvantages among interest groups and the public. For instance, the Biden administration might hesitate to upset steelworkers in the states of Michigan, Wisconsin, and Pennsylvania, which are crucial to his reelection. Although the rotating EU presidencies do not have comparable power, in 2023/24, there will be elections of the EU Parliament, a new EU Commission president will be appointed, and several EU member countries will hold elections. These developments might affect the EU’s positive inclination toward multilateral decarbonization approaches.

Fifth, which international developments affect the negotiations on GASSA? Lack of progress globally in mitigating global warming increases the pressure on industry. Yet, what likely creates a stronger impetus for progress in the negotiations for GASSA is China’s general dominance of steel production, many of the manufacturing and downstream sectors, and clean technology supply chains. There is a strong belief that China’s methods to boost its steel sector create unfair advantages and lead to global overcapacity and the lower prices of Chinese steel. GASSA negotiations are part of a complex and politically heated geopolitical situation, characterized by multiple crises ranging from COVID-19 to the Russian invasion of Ukraine, the subsequent food and energy crises, and further bilateral diplomatic clashes. Also, the global and domestic availability of renewable energies, hydrogen, CCS technologies, and metal scrap plays a crucial role. In general, it can be said that the United States is pursuing a much bolder approach toward China, whereas in the EU and Germany, governments and industrial groups are more hesitant.

Sixth, how do stakeholders in the steel sector push or hold back these negotiations? Many stakeholders are involved in the steel sector, such as environmental and social NGOs, unions, the steel companies’ interest groups, and the car and construction industries. What U.S. and EU industry groups have in common is their demand for clear and ideally harmonized decarbonization rules, e.g., on Measuring, Reporting, and Verification (MRV) systems. One main obstacle for the GASSA negotiations on both sides of the Atlantic is concerns that carbon standards could be arbitrary. Both regions have different starting points. In the EU, steel production is predominantly based on the Blast Furnace (BF) technology (61 percent of the crude steel production). In the United States, more companies use the less emissions-intensive Electric Arc Furnace (EAF) technology (68 percent EAF and 32 percent BF). EAFs use mostly scrap steel and can become even cleaner through the use of renewable energies. Steel industry groups fight over whether to use a one-size-fits-all carbon intensity-based standard (independent of the applied technology) or a sliding scale/multiple standards approach (that distinguishes between scrap based and primary steel). It can be assumed that many U.S. steel producers pressure their negotiators to pursue the one-size-fits-all standard, whereas EU industries seek to prevent this.

The discussion becomes politically sensitive because it is tied to perceived fairness and distributional concerns. For instance, some groups argue that the “effort” behind each ton of reduced emissions should be rewarded. With such an approach a BF producer, who achieves a relatively clean production but which is still dirtier than an EAF facility, would be rewarded. If GASSA’s standards were connected to financial benefits, e.g., the eligibility for governmental subsidies or procurement programs, there could be strong distributional impacts. The situation becomes even more complex when taking into account the different downstream industries. Overall, steel industry groups in the United States and the EU have historically been very successful in pushing policymaking in their favor.

What is a likely outcome in October?

The above discussion shows that many aspects remain complex and unresolved for the launch of a GASSA club. Also, this brief essay has only discussed the immediately relevant aspects for cooperation between the United States and the EU. Questions remain about how GASSA’s measures would be implemented and enforced to create a substantial value for the environment, but also about how a bilateral deal could then be turned into the intended global solution. For instance, how could crucial partners from the Global South, where large amounts of emissions can be expected in the future and trade relations for steel, hydrogen, and steel-based products will take place, be engaged?

Several possible outcomes from the GASSA negotiations can be envisioned. The most likely scenario is that negotiations will be postponed until after the U.S. elections and a new EU Commission is in place and be resumed in mid-2025. The EU and the United States could temporarily extend the current quota rule for the Section 232 tariffs. A more favorable scenario for climate policy would be that partners can at least agree on a very broad framework deal that sends a signal to the world that the United States and the EU are seriously committed to setting strict rules for steel decarbonization. Finally, the most negative scenario would be “no agreement” and the reimposition of Section 232 tariffs paired with the EU’s retaliation measures, leading to a renewed trade conflict. Such a situation, together with unilateral actions to counteract market overcapacity and protect decarbonization measures, could lead to a conflictual spiral at a moment when cooperation and solidarity among allies are most needed.[2] The international climate conference of the United Nations in November/December (COP 28 in Dubai) might bring a glimmer of hope. Many governments look at this event as an opportunity to make important—potentially prestige-building—announcements, and thus this would be an ideal moment for the United States and the EU to come forward with a GASSA club.

[1] Sectoral initiatives, clubs, and pledges have increased in the last few years in the climate policy landscape; examples are the G7 Climate Club led by Germany or the Global Methane Pledge.

[2] This essay builds on empirical information gathered by the author in multiple interviews, talks, and at observed events.

Supported by the DAAD with funds from the Federal Foreign Office (FF).