Armin Rodler via Flickr

Globalization under Pressure: Danger for the German Economic Model?

Jörn Quitzau

Bergos AG

Joern Quitzau is a Geoeconomics Non-Resident Senior Fellow at AGI. He is Chief Economist at Bergos, a private bank based in Switzerland. He specializes in economic trend research and economic policy. Joern Quitzau hosts two Economics podcasts.

Prior to his position at Bergos, Joern Quitzau worked for Berenberg in Hamburg (2007-2024) and Deutsche Bank Research in Frankfurt (2000-2006) with a special focus on tax and fiscal policy.

Dr. Quitzau (PhD, University of Hamburg) was a Visiting Fellow at AGI in April 2014 and September 2022 and an American-German Situation Room Fellow in April 2018.

The term globalization stands for an increasing economic and social interdependence worldwide. It is, or was, the result of three main factors: 1. the collapse of communism in Europe, the opening of China, and the East-West political détente; 2. trade liberalization; 3. advances in information and telecommunications technology. The three factors combined have led to the triumph of globalization since the early 1990s.

Hardly any other country has geared its economic structure as strongly to the international division of labor as Germany. Calculations by the German Economic Institute (IW Köln) show that Germany has the greatest degree of openness of all major economies. The sum of imports and exports in Germany amounts to 88 percent of gross domestic product (GDP). The average for OECD countries is 59 percent. If globalization were now to be reversed, the German economic model would potentially be at particular risk.

Trade economist Gabriel Felbermayr has used simulation calculations to show how much Germany benefits from the international division of labor: Compared to a hypothetical autarky state, real incomes were 38 percent higher in 2019. Germans have achieved significant income gains, especially between 1980 and 2010. In the past decade, however, the increase not only slowed down; the data actually showed a slight decline.

Since 2015, there have been several striking events that resulted in a shift away from globalization: Donald Trump’s trade policy, Brexit, the climate debate, the Coronavirus pandemic, and finally the Russia-Ukraine war. Two of the three globalization drivers mentioned at the beginning (East-West political détente, trade liberalization) no longer apply in full today.

While Donald Trump and Boris Johnson openly broke with parts of the globalization idea, the other factors have exposed the weaknesses of globalization. As a result, there will be some de-globalization in the area of trade in goods. Climate policy will lead to higher CO2 prices and thus higher transport costs, with the result that some goods trade may become unprofitable. Supply chains were partially disrupted during the pandemic, and problems with security of supply in an internationally networked economy came to light. And the Russian war of aggression ruthlessly exposed the energy dependency of the German economy in particular. It is clear that globalization means not only maximum efficiency, but also an increased degree of fragility.

A change can also be observed on the part of consumers. “Buy local” ideas, i.e. purchasing locally (ideally regionally produced goods), are gaining popularity for different reasons: to strengthen local trade against Internet mail-order companies or for a lower environmental impact due to shorter transportation distances. The motives are different from “America First,” but the result is similar—an international division of labor leading to greater trade in goods is losing importance.

Protectionism on the rise

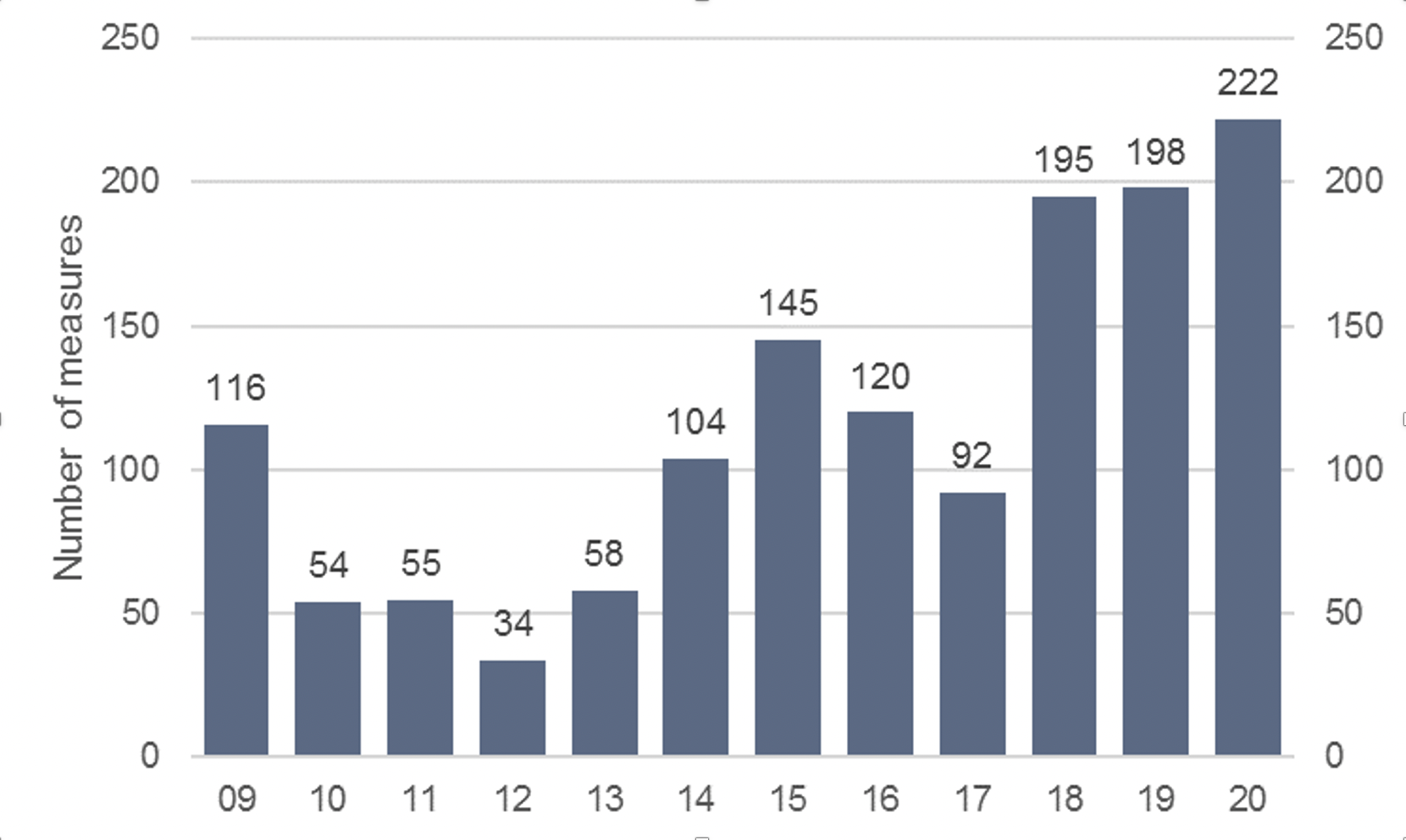

Protectionism is on the rise worldwide. In 2021 alone, almost 1,700 new restrictive measures were imposed. The balance of protectionist and trade-liberalizing measures against Germany has risen noticeably in recent years (see chart). Germany is a particularly frequent target of protectionist measures (2nd place behind China), but Germany is also very often the source of protectionist measures via the EU’s trade policy (3rd place behind the United States and China).

Trade policy measures against Germany

Protectionist minus liberalizing measures. Source: German Economic Institute (IW Köln)

Felbermayr points out that the EU uses trade policy for non-economic purposes, virtually as a supplement to or substitute for human rights or foreign policy, as the current sanctions against Russia confirm. International trade policy is thus definitely a threat to the German economic model, which has so far relied on largely frictionless exchange.

Diversification and “nearshoring” as an answer to supply chain problems

Many German companies are taking the experience of recent years as an opportunity to rethink the supply chains of their upstream products. The aim is to spread risks by diversifying suppliers, shortening supply chains, and reducing risks through regional proximity to the supplier (“nearshoring”). China plays a special role. A significant number of the trading companies stated in a survey by the Ifo Institute that they are currently dependent on key inputs from China.

Raw materials that often come from China (for example wind turbines and photovoltaic technology) are eminently important for the technologies at the heart of future markets. Many companies are currently rethinking their position, with the chemical industry at the forefront.

Conversely, the Chinese government is trying to urge European companies to expand their business activities in China and strengthen local supplier relationships in the process. If possible, Western companies should no longer export to China, but produce directly on site. Overall, China is using foreign trade relations to its own advantage, which in the long-term should also consist of making foreign companies or national economies dependent on China.

Conclusion

Due to its strong international orientation and the large share of industry, the German economy is vulnerable to a reversal in globalization in the area of trade in goods. The crises of the past few years have revealed some downsides of globalization that had not previously been sufficiently accounted for by economic models. These include the unequal distribution of globalization gains. This is a particular problem in countries like the United States that do not have a functioning welfare state. Why? Because globalization accelerates structural change, which inevitably produces losers in the domestic economy. These losers cannot be left alone, otherwise social tensions will ensue.

From 1990 until the global financial crisis, the focus was on the efficiency gains of globalization. In the years that followed, the focus shifted to vulnerability to disruptions of various kinds. The relationship between efficiency and fragility is now being rebalanced. If all goes well, future globalization gains in goods may not be as high as in the past, but growth will be less susceptible to disruption. Companies in Germany are already showing that they are embracing change and adapting to the new conditions. This bodes well for minimizing the expected welfare losses. However, if the globalization pendulum swings completely the other way and countries seek their salvation in exaggerated isolationism, then a great deal is at stake for the German economic model. A new study by the ifo Institute has just concluded that reshoring (to Germany) could lead to a 9.7 percent GDP loss in the long run.