Ilja C. Hendel via Federal Ministry of Finance

Trade Imbalances: Does the German Current Account Surplus Need to Be Corrected?

Holger Schmieding

Berenberg Bank

Dr Holger Schmieding is Chief Economist at Berenberg in London. Before joining Berenberg in October 2010, Holger worked as Chief Economist Europe at Merrill Lynch, Bank of America and Bank of America-Merrill Lynch in London. Having studied economics in Munich, London and Kiel, he holds a doctorate from the University of Kiel. Prior to this, he also worked as a journalist at Westfälische Nachrichten in Germany, as head of a research group on east-central Europe at the Kiel Institute of World Economics and as a desk economist at the International Monetary Fund in Washington, DC.

Jörn Quitzau

Bergos AG

Joern Quitzau is a Geoeconomics Non-Resident Senior Fellow at AGI. He is Chief Economist at Bergos, a private bank based in Switzerland. He specializes in economic trend research and economic policy. Joern Quitzau hosts two Economics podcasts.

Prior to his position at Bergos, Joern Quitzau worked for Berenberg in Hamburg (2007-2024) and Deutsche Bank Research in Frankfurt (2000-2006) with a special focus on tax and fiscal policy.

Dr. Quitzau (PhD, University of Hamburg) was a Visiting Fellow at AGI in April 2014 and September 2022 and an American-German Situation Room Fellow in April 2018.

U.S. president Donald Trump has recently imposed tariffs on imports of steel and aluminum. The goal of his protectionist approach is to protect the domestic industry against competition he views as “unfair.” While the U.S. suffers from chronic trade deficits, other countries (such as Germany) exhibit substantial trade surpluses. However, imposing tariffs on trade is not a proper way to improve domestic economic performance. In general, raising competitiveness is the key to more prosperity, employment, and growth.

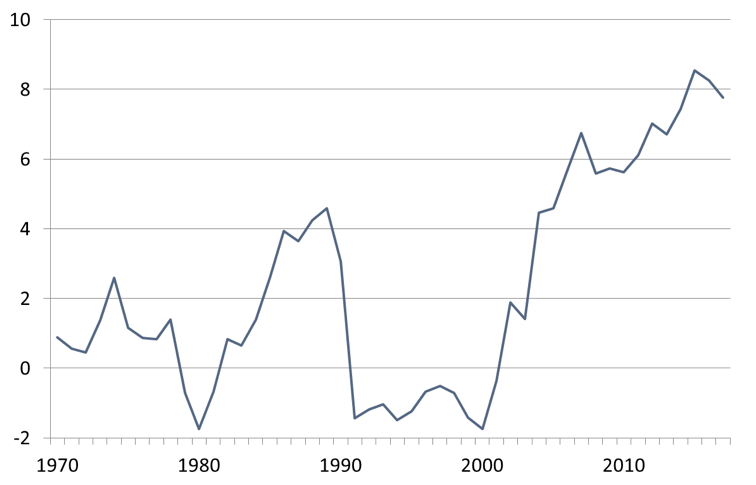

Apart from the president’s current trade policy approach, there has been a long and widespread debate on the question of whether the German current account surplus is excessive and whether it has to be corrected by a shift in Germany’s economic policy. The surplus peaked at 8.8 percent of GDP in 2016. Since then, the surplus has slightly decreased to 8 percent. However, Germany is still the country with the highest current account surplus in the world. Germany thus draws criticism from different sides because one country’s surplus is the mirror image of deficits in other countries. By definition, the global sum of surpluses and deficits is zero (abstracting from errors and omissions). Whether it is the U.S. Department of the Treasury, the International Monetary Fund, or some European countries with current account deficits, they all blame Germany for being “over-competitive” and implicitly accuse Germany of pursuing a “beggar-my-neighbor” policy. Is this justified?

A country with a current account surplus exports more than it imports. In other words: countries like Germany with permanent surpluses produce more than they can absorb, they save more than they invest at home. In the short term, an export-oriented policy can boost employment and the overall economic performance. However, everlasting trade surpluses are unreasonable as surpluses and savings are no end in itself. Sooner or later, the current account balance of a surplus country will likely move back toward balance. If not, the population of the respective country would permanently work more than would be necessary for its own living standard. The country would be sending money abroad without ever wanting to get the money back. More likely, the surpluses now are being generated as a nest egg for a future in which that country will be more reliant on imports. This is the case for Germany with its ageing society. Germans, especially the baby boomers, consume less than they could today in order to increase their purchasing power for the future. Thus, a noteworthy part of the German trade surplus is the result of a forward-looking population in a rapidly aging country.

However, everlasting trade surpluses are unreasonable as surpluses and savings are no end in itself. Sooner or later, the current account balance of a surplus country will likely move back toward balance.

All in all, Germany’s huge current account surplus reflects a mix of structural and cyclical factors. Cyclical factors include the undervalued euro exchange rate of recent years, low oil prices, and the cyclicality of German exports. Structural factors are demographics, public finances, and corporate savings and investments. As the exchange rate and the oil import bill have largely normalized and as other temporary factors are also fading, we expect the surplus to slowly decline toward 5 percent within five years. Once Germany’s baby boomers start to draw on their external savings in droves from roughly 2025 onward, the surplus will likely narrow substantially further.

The often-heard assertion that the German surplus has been caused by a lack of domestic demand is mostly wrong. Domestic demand had been exceptionally weak in the early years of the euro when Germany belatedly corrected its post-unification excesses. But that phase ended around 2005. The key driver for the subsequent surge of the German surplus until 2015 was the positive supply shock from Germany’s 2004 reforms (“Agenda 2010”). These reforms strengthened the labor market and the balance sheets of government and companies to such an extent that the country generated surplus capital which it used to invest and create jobs at home and abroad.

The gap between Germany’s fiscal surplus and persistent deficits elsewhere may explain a quarter of Germany’s external surplus. However, with German demand growth well above trend, a small fiscal surplus is exactly what Keynes would have deemed suitable for Germany. The onus to correct the imbalance should be on countries running major fiscal deficits at times of buoyant aggregate demand and/or full employment such as the U.S. and the UK.

With German demand growth well above trend, a small fiscal surplus is exactly what Keynes would have deemed suitable for Germany.

The period of pronounced wage moderation in response to record unemployment is long over. Full employment underpins solid gains in German wages and private consumption. Stoking this process artificially could backfire on Germany and its trading partners. With respect to the labor market, Germany would have to overcome its skill shortage. This would contribute to a normalized current account, as a part of the surplus is invested abroad by companies because this is where they find additional skilled labor.

While the general criticism of the surplus is not justified, Germany could do more to ease its shortage of skilled labor and utilize its human potential better. It also has some need to gradually step up public investment over time and to counteract a still-widespread anxiety about the future by making its pension, health care, and nursing care systems more sustainable. Such policies would make sense almost any time and in almost every country, though, regardless of the current account position.