European Central Bank via Flickr

The European Central Bank’s Inflation Dilemma

Alexander Privitera

AGI Non-Resident Senior Fellow

Alexander Privitera a Geoeconomics Non-Resident Senior Fellow at AGI. He is a columnist at BRINK news and professor at Marconi University. He was previously Senior Policy Advisor at the European Banking Federation and was the head of European affairs at Commerzbank AG. He focuses primarily on Germany’s European policies and their impact on relations between the United States and Europe. Previously, Mr. Privitera was the Washington-based correspondent for the leading German news channel, N24. As a journalist, over the past two decades he has been posted to Berlin, Bonn, Brussels, and Rome. Mr. Privitera was born in Rome, Italy, and holds a degree in Political Science (International Relations and Economics) from La Sapienza University in Rome.

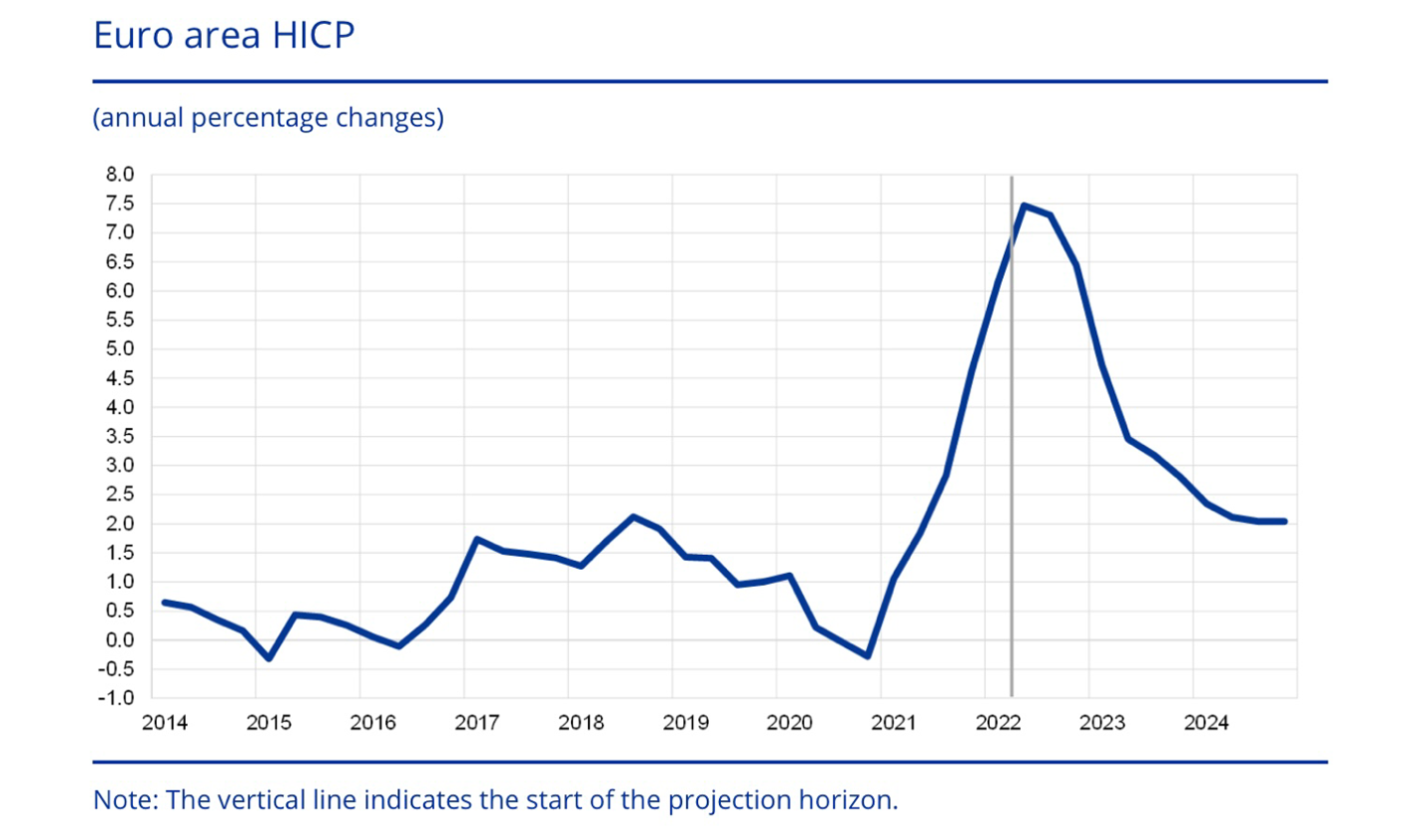

Major central banks have finally accepted that inflationary pressures are here to stay. Both the Federal Reserve and the European Central Bank now admit that price increases are not a transitory phenomenon. In May, headline inflation in the United States reached 8.6 percent. In the Eurozone, it stood at 8.1 percent. Both central banks have promised to tackle the challenge head on. In June, the Fed decided to increase its benchmark rate by 75 basis points (0.75 percentage points). By year end, the interest rate is expected to reach 3.4 percent. The ECB announced a hiking cycle of its own, although it is still taking a more cautious approach.

Both central banks face a very challenging environment, as most of the inflation is caused by factors beyond their control. These include the war in Ukraine—which is causing commodity prices to go up—as well as Covid-induced supply bottlenecks, such as restrictions in China.

Source: ECB

However, this is where similarities between the Fed and the ECB end. The inflation and GDP growth outlook make the ECB’s task more complicated. European inflation is still in large part supply rather than demand driven. In other words, unlike in the United States, at least until recently, the EU economy never came close to overheating. In fact, in most cases EU economies are still trying to get back to pre- pandemic GDP levels. That’s why many analysts speak of the risk of stagflation—the combination of high inflation and a stagnating economy. Monetary policy is further complicated by inflation dispersion—the fact that in some countries (such as France, Germany, and Italy) prices have increased within a 6 to 8 percent range, while others (e.g., some of the Baltic states) are experiencing an inflation rate close to 20 percent.

With inflation and growth already moving in opposite directions, the ECB has tried to calibrate its response very carefully. Any overly muscular move on inflation would make output deteriorate further, not only in weaker Eurozone countries. Germany is a case in point, given its dependence on Russian oil and gas and its strong manufacturing sector that makes the economy more exposed to supply bottlenecks. There is at least one other area that has some regulators such as Germany’s Bafin (Federal Financial Supervisory Authority), concerned, namely the housing market. Any abrupt upward interest rate move could have negative repercussions on the sector. Conscious of banks’ exposure to real estate asset, and the potential financial stability implications of abruptly cooling housing markets in Germany and elsewhere, policymakers would prefer to take a cautious approach.

Indeed, forcefully fighting rising prices will test the resilience of the financial sector. As long as inflation was low and monetary policy had been expansionary, the objectives of price and financial stability could be achieved with the same policy mix. Once inflationary pressures increased and the ECB decided to tighten financial conditions, the objectives started to diverge, as highlighted by widening spreads between sovereign bond yields of weaker Eurozone countries, such as Italy, and Germany. The development has alarmed the ECB, as it carries echoes of the euro crisis in 2012. But does it still matter today? Haven’t things fundamentally changed since then? Isn’t some repricing of the riskiness of sovereign bonds even a healthy development, necessary if the ECB is to be gradually replaced by private investors as dominant buyers of sovereign debt?

Some of the different answers provided to those questions have thrust never-reconciled schools of thought back to center stage. Defenders of unfettered markets, commonly known as “frugals,” believe that only market signals provide the right incentives for necessary improvements—structural reforms—in economies. According to the German finance minister, Free Democrat Christian Lindner, the ECB should not worry about widening spreads. Economists close to his thinking stress that market discipline is needed to force debt reduction measures and reduce the riskiness of sovereign bonds. Any outside financial support, whether provided in the form of monetary policies or indeed directly from the European Commission is seen as a distortion of market forces and should only be provided as a last resort, with strict conditionality attached. This approach was taken when austerity-driven policies 10 years ago exacerbated and arguably prolonged the euro debt crisis. More recently, this seemed to be replaced by the greater solidarity demonstrated with the launch of the NextGen EU common recovery fund in response to the Covid induced contraction. The return of inflation seems to be challenging the European playbook once again.

In fact, in the opposing camp represented by most populist parties in Italy, the predominant view is still that the ECB should be able to hoover up sovereign debt, unconstrained by legal limits. Economic thinkers on the far-right Lega call it the real “lender of last resort” function. Reformist Prime Minister Mario Draghi has been able to tame and sideline those forces within his own government. However, it is unclear what will happen once he leaves office next year. This partly explains why the frugals are still so reluctant to change their own approach towards the management of the Eurozone. To a certain degree, these ideologically opposed fronts are two sides of the same coin. Both are responsible for slowing down political progress towards a stronger monetary union.

The ECB finds itself caught in the middle, as recent events illustrate. When the ECB announced a tightening cycle in mid-June, it caused a sharp selloff in Italian sovereign bonds (BTPs). Only a few days later, the central bank reacted by announcing that it was speeding up work on a new anti-fragmentation tool, with the objective of compressing sovereign bond yields. The reasoning behind such a decision is very simple: if spreads on yields are allowed to widen too much, it becomes impossible to transmit monetary policy uniformly across the jurisdiction. In other words, if the market ignores the central bank’s monetary policy decisions, the ECB loses its ability to fulfill its mandate of achieving price stability, putting the very existence of the monetary union at risk.

The ECB is reportedly looking for an easily deployable anti-fragmentation instrument, designed to manage yield spreads more effectively and keep them within a safe range. Whether the new program should have any country-specific conditions attached is a matter for legal experts to determine. By treaty, fiscal and monetary policies are supposed to be kept separate. Conditionality blurs the line. But so can activating a targeted, country-specific asset purchase program.

Of course, since 2012 and the famous “whatever it takes” speech of then President of the ECB Draghi, the ECB carries the ultimate anti fragmentation tool in its arsenal, OMT (Outright Monetary Transactions). It allows the central bank to buy unlimited amounts of sovereign bonds of countries in distress. However, to be activated it needs a strict, country-specific reform program agreed with the ESM (European Stability Mechanism) and is intended to be used as a weapon of last resort. That makes OMT not an easily deployable tool. In some countries any ESM involvement is seen as politically toxic. In fact, OMT has never been activated.

The ECB faces a dilemma: it intends to fight inflation, but without triggering a cardiac arrest of the Eurozone. That is why fighting fragmentation is a core issue for the central bank. Once again, the current challenges expose the institutional limits of the Eurozone, notably the lack of a permanent and sufficiently large fiscal capacity able to allow the central bank to pay less attention to spreads in sovereign bond yields, focus entirely on the deployment of its traditional inflation fighting toolbox, and leave markets to play their price discovery role.